“Founders must understand the pros and cons of giving up too much of equity when launching their startups.” -Shruti Gurudanti, Rose Law Group partner and director of corporate transactions

By Haje Jan Kamps | Tech Crunch

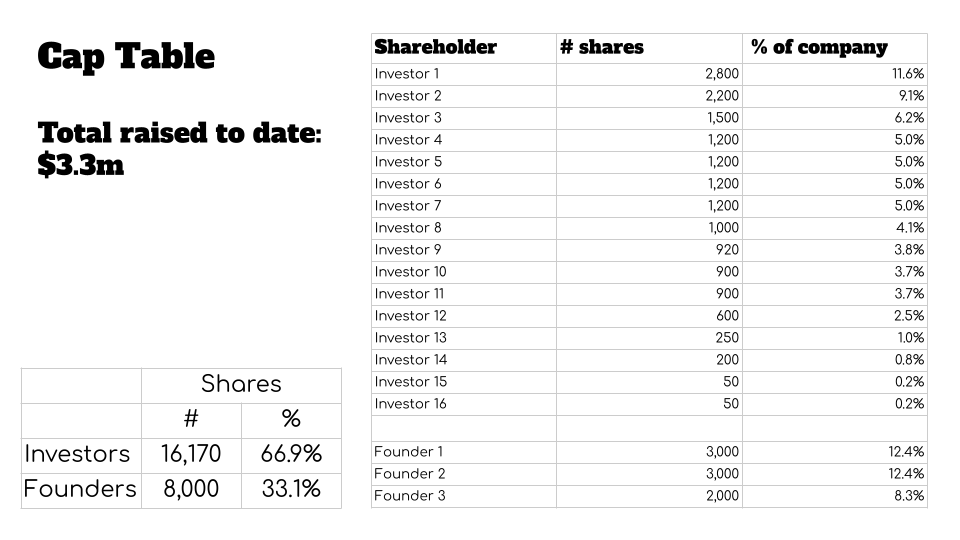

The CEO of a Norwegian hardware startup shared a pitch deck with me that had an unusual slide: It included the company’s capitalization table — the breakdown of who owns what part of the company. Typically, cap tables are shared in the diligence phase of investing.

Taking a closer look at the table, something is significantly amiss:

This cap table is a reproduced, accurate illustration of the cap table that was in the deck. It’s been simplified and redacted to remove the names of the investors. Image Credits: Haje Kamps/TechCrunch

The problem here is that the company has given up more than two-thirds of its equity to raise $3.3 million. With the company starting a $5 million fundraising round, that represents a serious hurdle.

TechCrunch spoke to a number of Silicon Valley investors, posing the hypothetical of whether they would invest in a founder who presented a cap table with similar dynamics as the one shown above. What we learned is that the cap table as it stands today essentially makes the company uninvestable, but that there is still hope.