By Stacey Barchenger | Arizona Republic

Over $4 million in federal paycheck protection bailouts buoyed the businesses of two candidates for Arizona governor during the COVID-19 pandemic, records show.

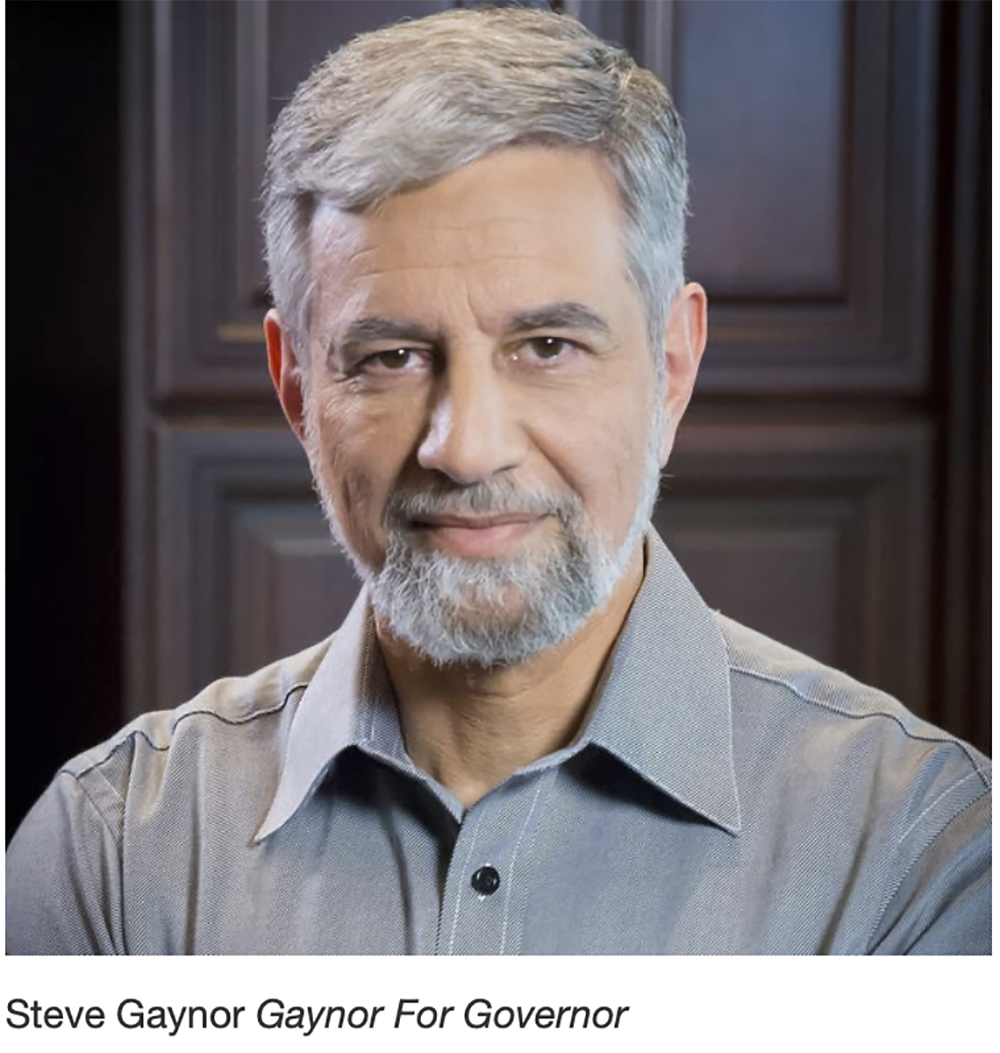

Both candidates — Republican Steve Gaynor and Democrat Aaron Lieberman — say the aid helped save dozens of jobs at their companies, and both said the highly scrutinized Paycheck Protection Program worked as intended.

Gaynor’s commercial printing business, B&D Litho California Inc., received nearly $1.6 million, of which about half was forgiven, meaning it does not need to be repaid.

The printer received an $844,470 loan in April 2020, according to Small Business Administration records compiled by ProPublica, the nonprofit news organization. B&D Litho California received another loan, of $740,025, in March of 2021 which is not yet forgiven or repaid, according to the records.

Gaynor, who is the CEO of B&D Litho California, said he stopped collecting a salary and cut expenses to save jobs when the pandemic hit, blaming a “heavy-handed government shutdown” that crushed industries. Gaynor estimated 35 jobs were saved, though he didn’t calculate how many exactly, and said most were equipment operators at the plant.

“Ultimately, my choice was to lay off dozens of long-time employees, or like my competitors, access the PPP loan program to keep them employed,” Gaynor said in an email. “In my case, the program worked as intended. If I had laid people off, the government would still have paid them through the unemployment program, but the disruption to the business and their long-term employment would have been severe.”

Several months after receiving the second loan, Gaynor began putting his own money into his campaign for governor. Gaynor committed $5 million in contributions and loans, and in a statement did not say whether the PPP money put him in the position to self-fund.

The Paycheck Protection Program was funded during the Trump administration, ultimately paying out about $800 billion in loans aimed to keep small businesses afloat as COVID-19 ravaged the country, threatening to tank the economy and forcing many states to shutter businesses in efforts to slow the spread of the virus.

The program offered low-interest loans of up to $10 million to businesses with 500 or fewer employees in most circumstances, and the loans were forgivable if a business maintained its payroll for several months after receiving the loan.

Of the total, about $678.6 billion has been forgiven, according to the Small Business Administration.