The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

By Elliot D. Pollack & Co. | Rose Law Group Reporter

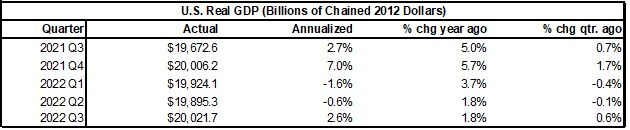

The U.S. economy grew in the third quarter but showed signs of a broad slowdown as consumer and business spending faltered under high inflation and rising interest rates. Gross domestic product—a measure of goods and services produced across the nation—grew at a 2.6% annual rate in the third quarter after declining in the first half of the year, the Commerce Department said Thursday (see image below).

Trade contributed the most to the third quarter’s turnaround as the U.S. exported more oil and natural gas with the war in Ukraine disrupting supplies in Europe. Consumer spending, the economy’s main engine, grew but at a slower pace than in the prior quarter. Businesses slashed spending on buildings, however, and residential investment fell at a 26.4% annual rate, the department said.

Stocks were mixed after the GDP release and earnings announcements. Treasury yields fell.

Economic uncertainty is growing, and many economists are worried about the possibility of a recession in the coming 12 months. The Federal Reserve’s efforts to combat high inflation by raising interest rates will likely continue and further weigh on the economy. Economists don’t expect the third-quarter rise in exports to endure, given a stronger dollar and weakening global economy. The full effects of higher interest rates likely have not worked their way through the economy suggesting low expectations for the next several quarters.

The U.S. isn’t the only part of the world facing economic challenges. The European Central Bank on Thursday raised its key interest rate to 1.5% from 0.75% as it too attempts to tame inflation in a region teetering close to recession.

One of the sectors most sensitive to interest rates—housing—is showing signs of pain. Home sales posted their longest streak of declines in 15 years and the average rate on a 30-year fixed-rate mortgage eclipsed 7% Thursday for the first time in more than 20 years.

Some of the economic slowdown this year reflects a return to a more normal rate of growth after the economy last year expanded at an unusually fast pace of 5.7% as it rebounded from earlier pandemic disruptions. The trajectory of the economy largely depends on how consumers fare in the coming months.

High inflation and rising interest rates haven’t done much to weaken the health of the American consumer. Data shows consumers continue to spend more. They also have more money in the bank than before the pandemic.

Consumers are benefiting from a tight labor market. Employers are holding on to the workers they have, with jobless claims remaining low last week. Many businesses are also ramping up pay as they struggle with staffing shortages.

U.S. Snapshot:

Personal income increased 0.4% for the month of September, with consumption expenditures growing by 0.6%. Consumers continued to be worried by inflation, but they continued to shop. Consumer spending accounts for two-thirds of the U.S. economy.

Consumer confidence fell during the month of October, after consecutive monthly increases. The dreaded inflation fears picked up again in October, dropping the confidence level 4.9% to 102.5. Increases in prices of gas and food were the primary contributors to the decline.

The University of Michigan Consumer Sentiment inched higher in the second half of the month, pushing the sentiment to 59.9. The index is now up 10 points from its low this summer but remains 16.5% below last year’s level.

New home sales (SAAR) fell 10.9% to 603,000, according to the U.S. Census. September’s sales level was down 17.6% as mortgage rates continued to increase. Last week, the 30-year mortgage rate passed 7% for the first time since 2002. Expectations remain for new home sales to slow even further as the average mortgage rate in September was 6.11% and averaged about 6.90% in October. Some of the only good news is that prices are expected to fall as builders start to cut prices to move inventory.

Arizona Snapshot:

The housing price deceleration continued for the second consecutive month in August, according to the Case-Shiller Index. Prices in Greater Phoenix fell 2.1% for the month. The composite-20 index, fell 1.6% and no metro area tracked by the index grew month-to-month. Year-over-year, Greater Phoenix’s price increase slowed to 17.1% compared to a year ago when the metro area saw an increase of 33.3%.