(CBS Viewer Screengrab)

By Lesley Stahl | CBS

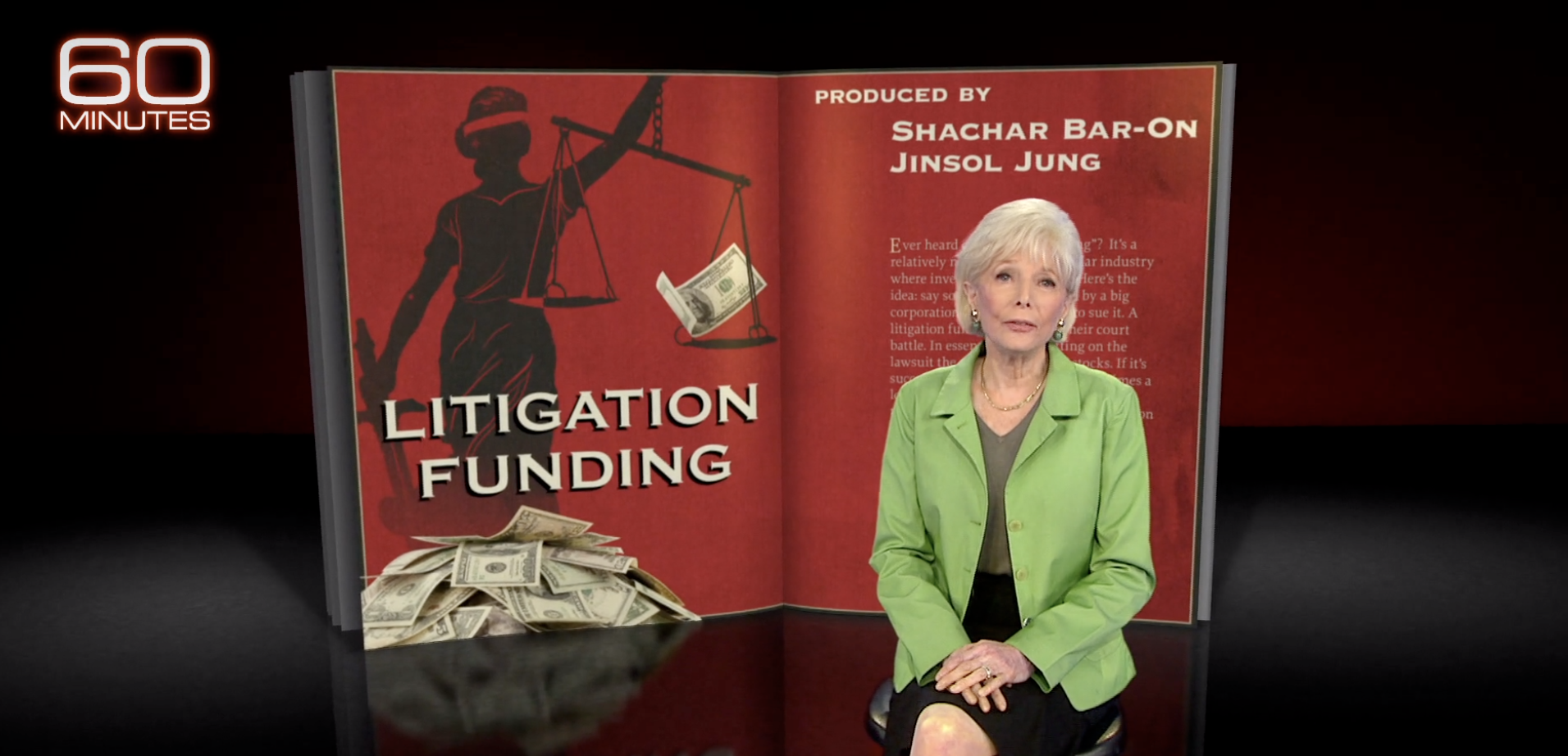

Ever heard of litigation funding? It’s a relatively new, multi-billion dollar industry where investors fund lawsuits. Here’s the idea: say someone was wronged by a big corporation but has no money to sue it. A litigation funder will pay for their court battle. In essence: they’re betting on the lawsuit the way traders bet on stocks. If it’s successful – they make money, sometimes a lot of money; if it fails – the funders get nothing – their investment is lost.

As we first reported in December, litigation funding can help in cases where otherwise the little guy who’s suing would just get crushed or lowballed by defendants with deep pockets. Problem is – this market is exploding with nearly no rules or oversight.

Craig Underwood: This is quite an honor to be able to drive you around in my truck.

We start our story in the rolling hills of Ventura County, California, where Craig Underwood’s family farm had been growing jalapenos for three decades.

Lesley Stahl: So you used to have peppers as far as the eye could see.

Craig Underwood: As you were driving through the Valley, peppers were everyplace.

Lesley Stahl: But I heard that you had one customer?

Craig Underwood: One customer. Huy Fong Foods.

Huy Fong makes the world-famous Sriracha Hot Sauce. In 2016, they abruptly severed ties with Underwood. His business dried up overnight.

Lesley Stahl: Is there anything growing here at all? Can you tell?

Craig Underwood: There’s nothing planted here. And up here, it’s just weeds —

Facing ruin, he sued Huy Fong for breach of contract and won: $23 million.

Lesley Stahl: But they appealed?

Craig Underwood: They appealed.

Lesley Stahl: You couldn’t collect any of the money?

Craig Underwood: No. We were looking at whether we could survive or not. Every week we were trying to find enough cash to pay the bills, make sure we could make payroll.

He couldn’t afford to keep fighting, until he heard of an investment firm that backs people in his situation.

Christopher Bogart: We make the playing field level. And that’s what people should be wanting in litigation.

Christopher Bogart is the CEO of Burford Capital. He funds litigants and takes a chunk of their award, if they win.

Christopher Bogart: We are a multibillion-dollar company because litigation is expensive. And there’s an awful lot of demand from businesses for this kind of solution.

Lesley Stahl: So is it a loan?

Christopher Bogart: It’s a non-recourse financing.

Lesley Stahl: What does “non-recourse”? What does that mean?

Christopher Bogart: What it means is that if the case that we’re financing doesn’t succeed, then we don’t get our money back. And so it’s different from a loan in the sense that a loan obviously you’re always having to pay back the principle.

Lesley Stahl: If your side loses, you get nothing?

Christopher Bogart: That’s correct.

“Is it spam or is it litigation funding? We’ve recently seen an influx of emails asking whether our clients are interested in litigation funding. It’s often difficult to determine whether these emails are genuine inquiries or clickbait because of the lack of regulatory oversight in litigation investing. Litigation funding raises a plethora of concerns. For instance, are litigation funding documents protected by the attorney work product doctrine? Is litigation funding considered “income” to the client and thereby discoverable in instances where a party claims lost wages as damages? If you are considering bringing in an investment firm to fund your lawsuit, please first meet with the attorney on your file to determine how it may affect your case.” –Rose Law Group litigator Sarah Sladick