By Paul Basha, Summit Land Management Traffic Engineer

Proposition 479 is the third in a series of transportation sales taxes within Maricopa County proposed by the Maricopa Association of Governments. The Maricopa Association of Governments is the Metropolitan Planning Organization (one of over 400 in the United States) for greater Phoenix. The Maricopa Association of Governments consists of 27 cities and towns, 3 Native nations, and representatives from Maricopa County and Pinal County. (The past and proposed sales taxes are only collected in Maricopa County, and the revenue is only spent in Maricopa County.)

The first such tax was approved by voters in 1985. The second such tax was approved by voters in 2004. For the past 40 years, the sales tax has been 0.5% of a product purchase (one-half cent per dollar). This means for every $2.00 you spend on a product; an additional one cent is charged. If Proposition 479 passes, then this 0.5% sales tax will continue from 2025 to 2045. (Long time. In 1985, 2005 seemed quite distant, as did 2025 in 2005.)

According to the Arizona Sales Tax Handbook, “sales tax is legally required to be collected from all tangible, physical products being sold to a consumer”. The Arizona Sales Tax Handbook also states, “The state of Arizona does not generally collect sales taxes on the vast majority of services performed.” The Arizona Sales Tax Handbook explains that grocery purchases are not taxed, though food purchased from caterers is taxed. Restaurants also charge the sales tax.

The current Maricopa County sales tax rate – which includes the 0.5% transportation sales tax – is 2.0%. The Arizona state sales tax rate is 5.6%. Each City, Town, or School District can also charge a separate sales tax. The highest sales tax rate in Arizona, combining taxes from all applicable jurisdictions, is 11.7% in both Florence and Casa Grande. The lowest sales tax rate in Arizona occurs in many local jurisdictions within Mohave County, where the sales tax rate is 5.6%. However, the cities of Colorado City, Kingman, Lake Havasu City, and Bullhead City; each also have local sales taxes.

(We have nine states with no state income tax, and five states without a state sales tax. Included in those two lists are Alaska and New Hampshire, which have neither an income tax nor a sales tax. Some suggest we should have a federal sales tax rather than a federal income tax. In fact, according to Forbes, the United States House of Representatives voted down a federal sales tax in 1932. Also according to Forbes, a Republican from Georgia has proposed a federal sales tax every year since 1999. Also according to Forbes, to replace and equal current federal income tax revenue, a federal sales tax is estimated to need to be $30 on a $100 purchase.)

While we’re on the federal tax topic, the current federal gasoline tax is 18.4 cents-per-gallon. The first federal gasoline tax was 1 cent-per-gallon, adopted on 6 June 1932. This tax has increased eight times since 1932, until the current rate was adopted in 1993. This tax was intended to be a user fee – the more you drove on roads, the more gasoline you used, so the roads were funded. However, for at least the past 40 years, some vehicles use considerably less gasoline-per-mile than other vehicles. Thereby, the foundational basis is no longer valid. In fact, drivers of electric vehicles pay no gasoline tax, and still use the roads that drivers of gasoline-powered vehicles pay gasoline tax to provide.

The Arizona state gasoline tax is an additional 19 cents-per-gallon. The driver and vehicle license fees we pay are also used to fund road improvements. Arizona funds 47% of road improvements with road user fees, ranking 30th in the nation. The transportation sales tax is part of the 53% non-road-user-fee funding for road improvements. Hawaii has the highest percentage of road improvements funded by user fees at 73%. Florida and New Jersey are second and third at 72% user-fee funding for road improvements.

In Arizona, the cost of roads is much greater than the revenue collected by federal and state gasoline taxes.

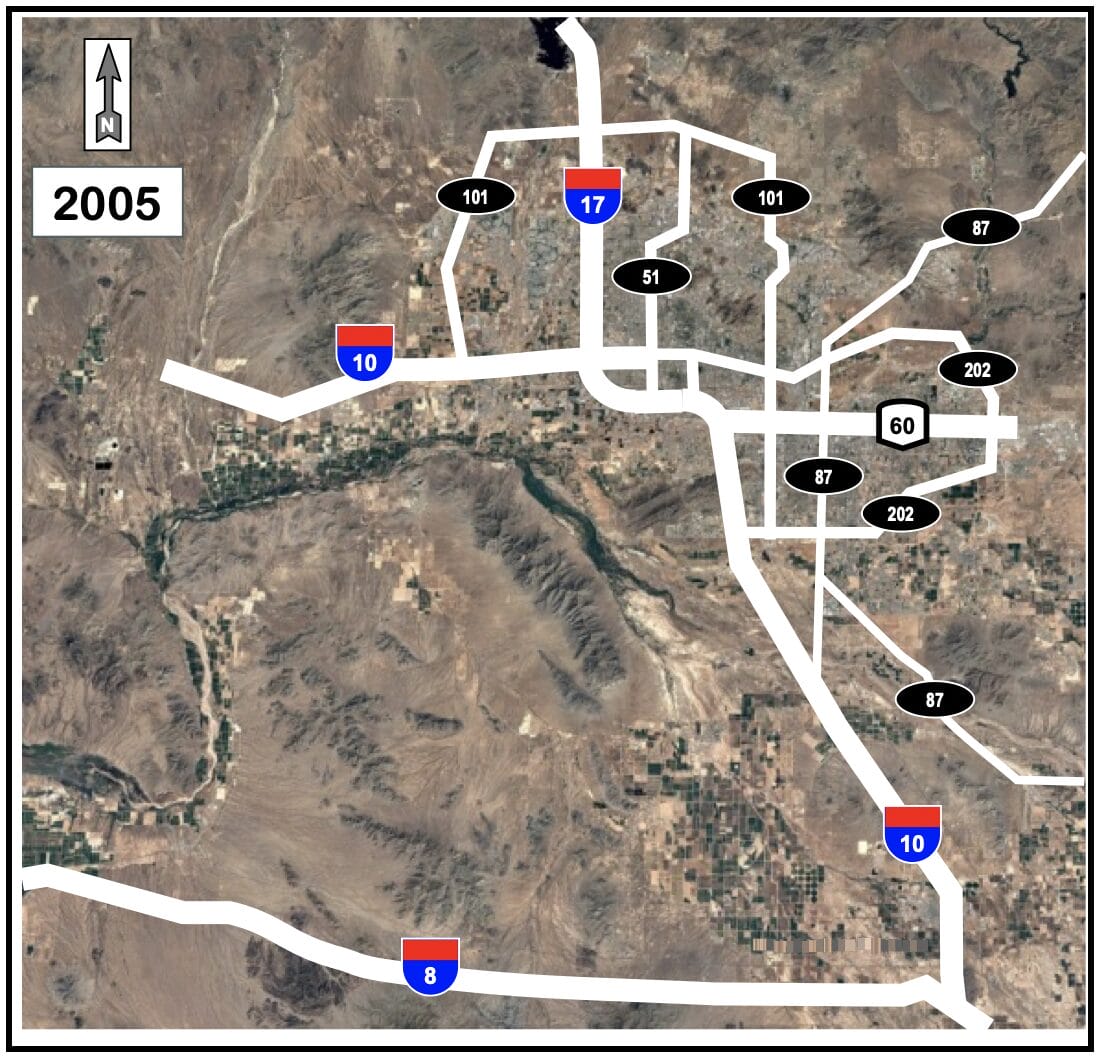

We have freeways and arterials in Maricopa County because for the past 40 years we have paid 1 additional cent for every $2.00 we spend purchasing a product in Maricopa County. Our current metropolitan freeway system is depicted below.

Our metropolitan freeway system in 1984 – prior to our first transportation sales tax – is provided below.

The Valley of the Sun only had two freeways in 1984, and they did not connect. The final segment of I-10 was constructed in 1990 – partially funded by the Maricopa County 0.5% transportation sales tax. (Incidentally, that was the final segment of I-10 from the Pacific Ocean to the Atlantic Ocean.) So, thank you to everyone who purchased products in Maricopa County from 1985 to 2005 – you gave us that vital freeway connection, and much more. The freeway system constructed during those 20 years is indicated on the aerial photograph below.

Can you imagine not having State Routes 101, 202, and 51 today? Phoenix is the 5th largest city in the United States because of this freeway system.

While we’re on the topic, east-west freeways are even numbers and north-south freeways are odd numbers. Minor freeways branch from a major freeway and have three digits. The second and third digits are the number of the connecting major freeway. If the first digit of a minor freeway is an even number, then the minor freeway reconnects to the major freeway. Think of I-805 in San Diego, or I-210 and I-215 in Los Angeles, or I-405 in both Los Angeles and Seattle, or I-280 in San Francisco, or I-680 and I-880 in Oakland. If the first digit of a minor freeway is odd, then it does not reconnect to the major freeway. Think of I-505, I-580, and I-780 in Oakland.

If Proposition 479 is approved by voters, 40.5% will be allocated to freeways and highways, 22.5% will be spent on arterial roads and regional transportation infrastructure, and 37% will be spent on transit. The sales tax revenue will provide:

331 New Freeway Lane-Miles

134 New Freeway High Occupancy Vehicle Lane-Miles

43 New or Improved Freeway Interchanges

3 New or Improved Interchanges Between Freeways

19 New or Improved Directional High Occupancy Vehicle Interchange Ramps

1,000 New or Improved Street Lane-Miles

Support for 11.9 New Light Rail Miles

Support for 28.3 Bus Rapid Transit Miles

Support for 4.4 New Modern Streetcar Miles

One of the new freeways will be SR-30 which will be approximately 3 to 5 miles south of and parallel to I-10, from I-17 into Buckeye. Another new freeway will extend SR-24 from Ellsworth Road to Ironwood Drive. The Arizona Department of Transportation wisely already constructed the freeway ramps for this four-mile segment, only the mainline needs to be constructed.

There will be 13 notable projects in the Central Valley, 11 notable projects in the East Valley, and 14 notable projects in the West Valley.

Whether we like it or not, whether we admit it or not, us people in the Valley of the Sun drive a lot. We cannot drive very far without roads. Roads cost money. Very logical that the money should come from people who purchase products. Quite obvious that people who purchase products in stores and restaurants, must travel to make those purchases. Equally obvious that people who purchase products online, must have those products delivered by vehicles that travel. Here in metropolitan Phoenix, our travel is almost always on roads. Logical that the roads we all use in Maricopa County should be partially paid by sales taxes.

We have three choices: stop driving on roads, waste more time in congestion on roads, or vote yes on Proposition 479.

Curious about something traffic? Call or e-mail Paul at (480) 505-3931 and pbasha@summitlandmgmt.com.