By Motley Fool, Universal Press Syndicate

By Motley Fool, Universal Press Syndicate

Once you reach retirement with a nest egg at your disposal, it’s hard to know how much of your savings you can afford to withdraw and spend each year.

A long-standing rule of thumb has been to withdraw 4 percent of it in the first year, adjusting the withdrawal for inflation in subsequent years. This has allowed many investors to tap their portfolios over 30-year spans without running out of money.

It’s not perfect, however. For starters, the rule doesn’t provide as much income as we might want.

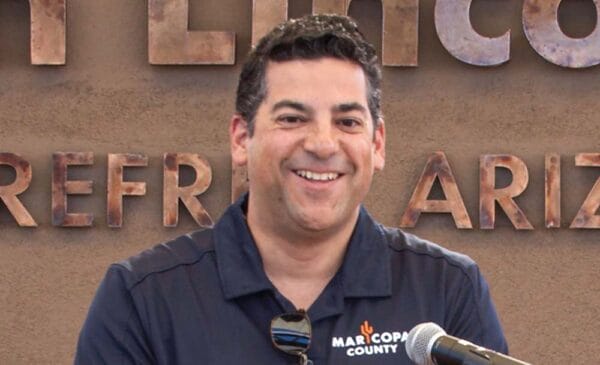

If you’d like to discuss estate planning, contact Laura Bianchi, chairman of Rose Law Group Estate Planning/Asset Protection Department, lbianchi@roselawgroup.com