By Phil Riske, managing editor

By Phil Riske, managing editor

A WalletHub study just reported Arizona ranks in bottom fifth of states for tax fairness.

At the same time, Kiplinger on Monday named Arizona a top tax-friendly state.

Both analyses concentrated on state sales taxes, although WalletHub deals with all sources of revenue for both state and local governments.

Arizona has one of the most regressive tax systems in the country according to WalletHub, reports Howard Fischer of Capitol Media Services.

The analysis by the financial advice firm notes state and local governments here rely heavily on sales taxes. That has a greater proportional impact on those at the bottom of the pay scale than those at the top, as they pay more of their income in taxes on what they purchase, Fischer reported

WalletHub ranks Arizona 41st out of the 50 states in “tax fairness,” placing Arizona among states where the bottom 20 percent of earners are the most “overtaxed.”

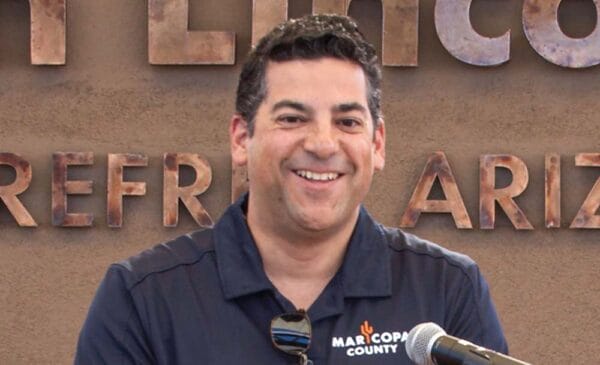

Govenor Doug Ducey’s spokesman Daniel Scarpinato told Capitol Media Services the governor has concerns about the unfairness of sales taxes.

Ducey last year submitted legislation to reduce taxes every year and this year signed legislation to index income tax brackets, laws analysts forecast will reduce state revenues by almost $40 million over the next two fiscal years, with increasing loses in following years.

Sen. John Kavanagh, R-Fountain Hills, told Fischer the WalletHub report that says Arizona’s tax system is regressive misses a key point.

“Half the people don’t pay any income tax,” he said. And he said about half of all individuals – potentially in the same group – get some type of government benefit.

WalletHub put Arizona at No. 41 in terms of dependency on sales taxes, with No. 1 being the least.

At the same time, Arizona had the eighth lowest reliance on individual and corporate income taxes, money that goes only to the state. And tax rates are dropping. Capitol Media Services reported.

WalletHub also found Arizona square in the middle of reliance on property taxes, at No. 25.

Out of an estimated $9.1 billion in taxes to be collected by the state this year, close to 47 percent is predicted to come from sales taxes. Another 40 percent is in individual income taxes, with about 7 percent in corporate income taxes and the balance is other taxes.

Kiplinger named Arizona a top 10 state when it comes to tax friendliness, noting

high sales tax (currently 5.6 percent) offsets the low property tax, as an example.

“Arizona fares well compared with Texas and Colorado, two of its main economic development rivals. California jockeys with New York and Illinois as the least tax-friendly states,” Kiplinger reported.