Money managers lobby lenders to make more ‘Alt-A’ loans or even buy mortgage-origination companies to control more of the supply themselves

Money managers lobby lenders to make more ‘Alt-A’ loans or even buy mortgage-origination companies to control more of the supply themselves

By Kirsten Grind | The Wall Street Journal

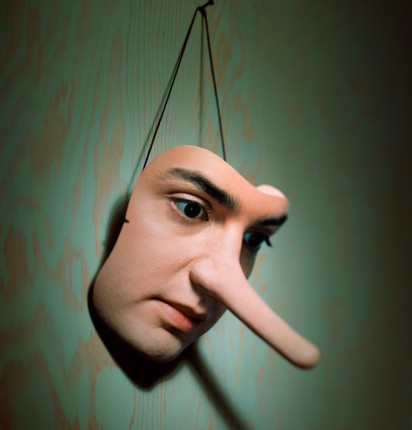

These mortgages, which are given to borrowers that can’t fully document their income, helped fuel a tidal wave of defaults during the housing crisis and subsequently fell out of favor.

Now, big money managers including Neuberger Berman, Pacific Investment Management Co. and an affiliate of Blackstone Group LP are lobbying lenders to make more of these “Alt-A” loans—or even buying loan-origination companies to control more of the supply themselves—according to people familiar with the matter.