By Diana Olick | CNBC

By Diana Olick | CNBC

It is the No. 1 barrier to entry for young, would-be homebuyers: credit. Millennials are the first generation to come of age in a post-almost-apocalyptic housing market, where lenders, eight years later, are still paying billions in reparations for mortgage misconduct and outright fraud.

Millennial homebuyers are also paying a price.

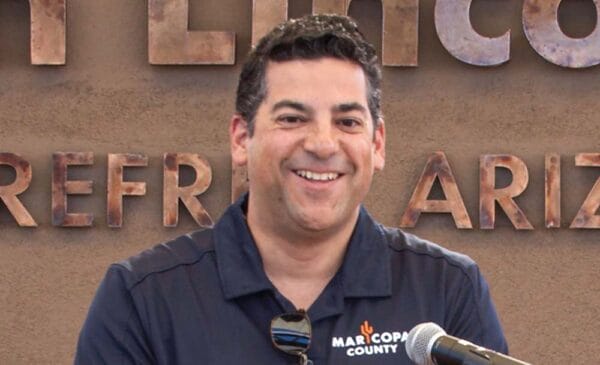

“The mortgage industry is poised to experience a monumental shift as more millennial homebuyers begin to enter the market,” said Joe Tyrrell, executive vice president of corporate strategy at Ellie Mae, a mortgage software and data company. “There are roughly 87 million would-be homebuyers in the millennial generation and 91 percent of them say they intend to own a home one day. Lenders must prepare today to meet their needs.”