Buying a home during a pandemic.

By Ron Lieber | New York Times Your down payment fund was safely in cash. You’d planned, perhaps for years, for the 2020 home-buying season.

By Ron Lieber | New York Times Your down payment fund was safely in cash. You’d planned, perhaps for years, for the 2020 home-buying season.

REALTORMagazine Young adults may be eager to buy, but 75% of first-time home buyers say they’re overwhelmed about the purchase process, according to TD Bank’s

By Melissa Dittmann Tracey | REALTOR Magazine Who are your clients these days? Home buyers are ready to plant roots: Today’s buyers are young, multicultural,

Realtor Magazine The lower price of a fixer-upper and the added resale value after a remodel can be alluring to some home buyers. For example, the

Ahwatukee Foothills News Prospective home buyers may have to turn to new houses instead of resales if they hope to find new digs any time

Nearly half of the firms on this year’s Builder 100 list are staking a claim to the rapidly changing active adult home-buying market. Here’s why.

By Liana Enriquez and Gary Harper | azfamily For years, home buyers have kept moving further and further out, but that’s changing. In fact, the

The U.S. unemployment rate has hit 3.6 percent. It’s lowest level since 1969 and April saw 263,000 new jobs created beating economists’ expectations of 185,000

By Skyler Olsen | Zillow If you thought there were a lot of first-time home buyers over the past 10 years, check out what’s coming:

New-home buyers still can find bargains in metro Phoenix, but long drives are part of the deal By Catherine Reagor |Arizona Republic Higher prices have

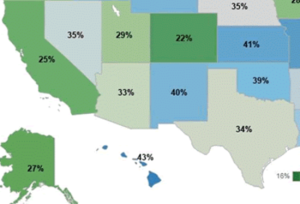

By Rose Quint | Eye On Housing Affordability continues to be a serious constraint for prospective home buyers. One way to find out buyers’ perception about this

A market’s fork-in-the-road moment means either seizing control or letting gravity take its course and riding it out. What will you do? By John McManus

By Matthew Speakman | Zillow As home values continue to rise, reaching a U.S. median of $218,000 in July and 197 markets experiencing median home

Realestate.com Home buyers — especially first-time buyers shopping for entry-level homes — can expect to pay a significant premium for houses with listings that

REALTOR Magazine Young adults express such a strong desire to own a home that they are willing to take on extra work or make

By Rose Quint | NAHB NAHB regularly conducts national polls of American adults and home buyers in order to understand new trends and preferences in

NAHB Despite eight decades and a multi-generation divide, prospective home buyers in 1938 expressed preferences for many of the same features and amenities favored by

Rate rises may not have the impact many expect. Builder Just 6% of prospective home buyers would halt their home search if mortgage rates rose

By Clare Trapasso | Realtor.com Home buyers pinching their pennies should rejoice: Existing-home prices are continuing to drop. Sorry, sellers! The median price of an existing home

Consumer advocates worry such programs tend to drive up prices By Laura Kusisto | The Wall Street Journal Student loan debt has been an obstacle for

Builder First-time home buyers purchased 570,000 single-family homes in the second quarter, compared to 426,000 in the first, marking the highest number of first-time home

Data suggests there is a significant and growing shortage of lower-priced homes and a glut of high-end ones By Laura Kusisto | The Wall Street

By Clare Trapasso | realtor.com A lot of ink has been spilled over the woes of first-time home buyers struggling to save up for a

Jann Swanson | Mortgage News Daily All cash sales continued at an elevated level in January, increasing from December but accounting for a substantially lower

By Michele Lerner | The Washington Post At the beginning of 2014, the federal government imposed stringent new rules that increased the ratio of income

Rose Law Group pc values “outrageous client service.” We pride ourselves on hyper-responsiveness to our clients’ needs and an extraordinary record of success in achieving our clients’ goals. We know we get results and our list of outstanding clients speaks to the quality of our work.

“The Olympic Committee is notoriously active in policing the use of their trademarks. They cannot forbid companies for mentioning the Olympics or accurately describing someone

“The data center and AI industries need to figure out a way to continue to grow, given our current power production constraints and Sam Altman

AI’s growing impact: Artificial intelligence (AI) is rapidly changing the way business is done. But with the great opportunities of AI comes new risks and strategic

By InBusiness Phoenix Rose Law Group, Arizona’s largest woman-founded lawfirm announce the addition of Paige Kemper as an Associate Attorney in the firm’s litigation and

(Photo courtesy of Resolution Copper, ©David Howells 2022, davehowellsphoto.com) (Disclosure: Rose Law Group represents Resolution Copper.) By Kyle Backer | AZ Big Media Since Pinal County

By Howard Fischer | Capitol Media Services The Sunday announcement by Joe Biden that he was not running for reelection and endorsing Vice President Kamala

Rose Law Group Reporter, which provides Dealmaker’s content and service, is contracted by Rose Law Group. Rose Law Group is a full service real estate and business Law Firm practicing in the areas of land use/entitlements, real estate transactions, real estate due diligence/project management, special districts, tax law, water law, business litigation, corporate formation, intellectual property, asset protection, data breach/privacy law, ADA compliance, estate planning, family law, cyber-law, online reputation and defamation, lobbying, energy and renewable energy, tax credits/financing, employment law, Native American law, equine law, DUIs, and medical marijuana, among others. The views expressed above are not necessarily those of Rose Law Group pc or its associates and are in no way legal advice. This blog should be used for informational purposes only. It does not create an attorney-client relationship with any reader and should not be construed as legal advice. If you need legal advice, please contact an attorney in your community who can assess the specifics of your situation.