The Monday Morning Quarterback/A quick analysis of important economic data released over the past week

The news continues to be generally upbeat. This is to be expected at this point in the cycle. It’s bad news/good news. The bad news is that the expansion is, and will likely remain, anemic by historic standards. The good news is that continued expansion should last for quite some time.

Arizona Snapshot

The seasonally adjusted unemployment rate in Arizona dropped 0.1% to 7.5% in January. A year ago, the rate was 8.0%.

Compared to a year ago, Arizona gained a total of 55,400 nonfarm jobs (2.2%) in January. The largest gains were in Trade, Transportation & Utilities (14,400 jobs), Education and Health Services (13,800 jobs) and Financial Activities (12,300 jobs).

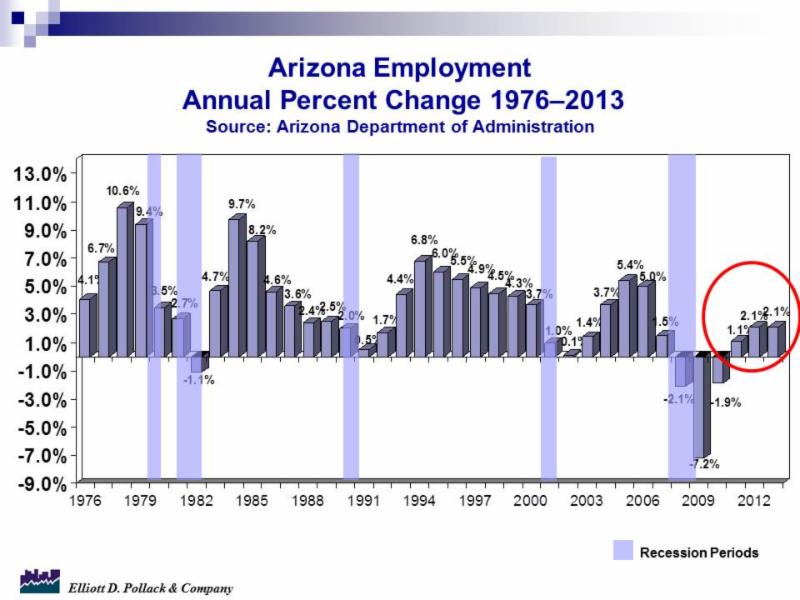

As can be seen in the chart at the end of this report, this cycle has been the weakest on record. This, combined with the high unemployment rate, go a long way to explaining the anemic population growth and also the weak housing market.

Compared to a year ago, Greater Phoenix gained a total of 48,400 nonfarm jobs (2.7%) in January. Greater Tucson added 3,300 jobs (0.9%) over the same period.

According to The Wilcox Report, only about 29% of single family properties were purchased in cash in February 2014 compared to over 40% a year ago. This is an indication that investment buying has slowed considerably.

U.S. Snapshot

The consensus forecast of U.S. inflation adjusted (real) GDP declined mainly due to restraint on activity that will result from this winter’s unusually harsh weather. On a year-over-year basis, real GDP is now expected to grow by 2.7% in 2014. This is 0.2% less than a month ago, but 0.8 of a point better than the 2013 increase of 1.9%. For 2015, the consensus is growth of 3.0%. Growth in this cycle has yet to match the average for recovery/expansion periods over the last 20 or 40 years.

The University of Michigan consumer sentiment index dipped in February, but the dip was not due to assessments of current conditions. The composite index was down 1.7 points as a result of the future expectations component. The current conditions component was actually higher by 0.7 points.

Retail sales made a comeback in February, but January was weaker than initially estimated. Weather is still a factor. Retail sales rebounded 0.3% in February after declining 0.6% in January. The February increase was slightly above expectations.

Manufacturing and trade inventories were up in January, but manufacturing and trade sales were down. Again, this was primarily due to severe weather. Thus, the inventories/sales ratio increased from 1.30 in December to 1.32 in January. Businesses react to unwanted inventories by slowing production growth and also employment growth. However, the buildup, to the extent it is tied to weather related shopping disruptions, could correct when spring arrives.