The Monday Morning Quarterback / A quick analysis of important economic data released over the past week

The past week has proven to be interesting, to say the least. However, this is the stuff of dissertation and not a brief morning economic update to be read while drinking coffee. We will say this though: now is the time to again promote the best that Arizona has to offer and to continue the good work of building the state’s economy.

Arizona Snapshot:

Arizona unemployment claims continue to see improvements. Total claims are 23.0% below a year ago for the week of February 22.

New housing data for the local market revealed the extent that prices appreciated in 2013. The S&P/Case-Shiller Home Price index for the Phoenix market shows 15.3% over the previous year. This compares to 23.0% growth for 2012. December did slip slightly, by 0.3% compared to November.

Foreclosure data compiled by Fletcher Wilcox shows disruptions in the Greater Phoenix home market nearing the end. January foreclosure starts were below January 2007 levels, auctioned properties and short sales were at levels not seen since pre-recession data.

U.S. Snapshot:

The most notable data release was the revision to U.S. Real GDP. The 4th quarter estimate of 3.2% was revised downward to 2.4%. This would normally be of greater concern but the 3.2% initial estimate was already higher than anticipated. Despite this revision the rate of growth in the second half of last year still approached 3.3%. This is close to the longer-term average for expansion periods and will likely continue at a respectable pace throughout 2014. The one caveat is that several reports have warned of depressed economic activity in the 1st quarter of this year due to the extreme weather conditions in the eastern part of the country. We first heard about these conditions on the radio while playing golf in shorts here in town. If the 1st quarter is marginally depressed it will not likely continue into the second quarter. In fact, some pent up demand may be building and some recovery of lost activity could be realized as things warm up.

Other notable economic data releases are below:

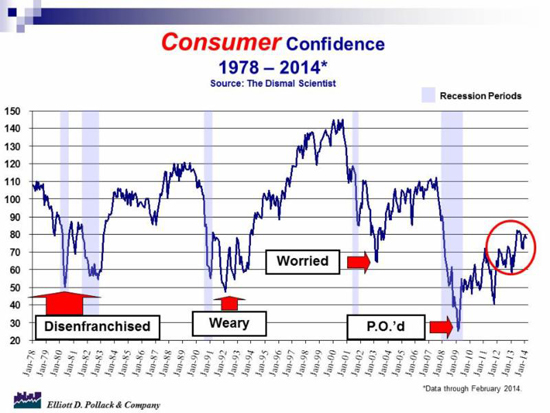

In February, the composite index for consumer confidence fell slightly to a lower than expected 78.1 (see chart below). This however masks the solid improvement in the present situation component which is the highest level since 2008. The University of Michigan index has held steady through this winter’s heavy weather and remains at 81.6 compared to 81.2 a month ago.

Manufacturer’s new orders for durable goods declined in January but stand 4.6% above a year ago.

New home sales surged a higher than expected 9.6% in January. This is the strongest annual rate since mid-2008. Unlike sales of existing homes, new home sales were not held down by January’s heavy weather. Over the year, new home sales were up 2.2%.