Pollack: Real estate ‘disaster’ ‘in the rear view mirror’

The Monday Morning Quarterback /A quick analysis of important economic data released over the past week

Elliott D. Pollack & Company

It’s hard to find fault with recent economic data. It points to the fact that the economy is in a strong phase of the cycle, albeit at a level of growth that is weak by any historic comparison. But, the economy is moving forward and should continue to do so for some time. The strength needed to accelerate the economy back to normal levels of expansion has to come from the construction sector. That is not likely to take place this year or next.

Arizona Snapshot:

According to the Cromford Report, the number of listing in the Greater Phoenix area as of March stands at 30,314, up a whopping 41.2% over a depressed March 2013 number of 21,476. This, combined with a decline in single-family resales of 16.6% from a year ago, has resulted in the number of days a listing is on market before being sold increasing to 83 from 73 a year ago.

In addition, prices have flattened out over the past several months as supply and demand move back into balance.

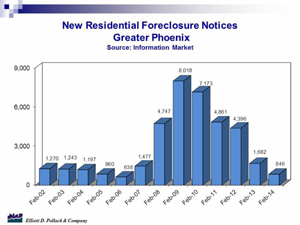

Other data related to the real estate market show how much it has improved. For example, new residential foreclosure notices have declined to the lowest levels since 2006 and are below levels seen in the early 2000’s (see chart). In addition, the number of distressed properties in the Greater Phoenix area has declined from over 60,000 in 2010 to less than 10,000 at the present time. Thus, evidence continues to show that the real estate disaster, despite some lingering effects, is in the rear view mirror.

Other data related to the real estate market show how much it has improved. For example, new residential foreclosure notices have declined to the lowest levels since 2006 and are below levels seen in the early 2000’s (see chart). In addition, the number of distressed properties in the Greater Phoenix area has declined from over 60,000 in 2010 to less than 10,000 at the present time. Thus, evidence continues to show that the real estate disaster, despite some lingering effects, is in the rear view mirror.

U.S. Snapshot:

Despite possible glitches in the data due to the timing of Easter this year vs. last, initial unemployment insurance claims dropped last week to a level not seen since the Great Recession began. This bodes well for the unemployment outlook over the next month.

The latest Blue Chip economic forecast suggests that real GDP growth this year will end up at 2.7% and next year the economy will expand at 3.0%. This follows 1.9% real growth last year and would make 2015 the best year the economy has seen since 2006.

Consumer credit continues to be a “tale of two cities”. Credit outstanding for non-revolving debt such as auto and student loans continues to expand at a rapid (10.1%) annual rate and is 7.7% over a year ago. On the other hand, revolving credit, mainly credit card debt, expanded at a more modest 3.5% annual rate last month and stands only 0.5% over a year ago. This indicates that consumers are being careful with the use of credit for non-durable items.

The wholesale trade inventories/sales ratio stood at 1.19 in February. This is up modestly from 1.17 a year ago and suggests that inventories are not out of line with sales. This means that as sales continue, the inventories needed will result in continued manufacturing rather than come from existing inventories.

Preliminary data from the University of Michigan consumer sentiment survey show that consumer confidence grew in April to 82.6, up from 80.0 in March and 76.4 a year ago.

Arizona Snapshot:

According to the Cromford Report, the number of listing in the Greater Phoenix area as of March stands at 30,314, up a whopping 41.2% over a depressed March 2013 number of 21,476. This, combined with a decline in single family resales of 16.6% from a year ago, has resulted in the number of days a listing is on market before being sold increasing to 83 from 73 a year ago. In addition, prices have flattened out over the past several months as supply and demand move back into balance.

Other data related to the real estate market show how much it has improved. For example, new residential foreclosure notices have declined to the lowest levels since 2006 and are below levels seen in the early 2000’s (see chart below). In addition, the number of distressed properties in the Greater Phoenix area has declined from over 60,000 in 2010 to less than 10,000 at the present time. Thus, evidence continues to show that the real estate disaster, despite some lingering effects, is in the rear view mirror.