The Monday Morning Quarterback /A quick analysis of important economic data released over the past week

ELLIOTT D. POLLACK & Company

The biggest story this week had to do with employment. It was a good report and an indication that the poor showing in December and January was weather-related. People continue to drop out of the labor force at a rate higher than expected. This offsets bad news earlier in the week related to first quarter real GDP. Other indicators such as personal income and consumer confidence were both healthy. And manufacturing continued to pull along with some positive reports. For Arizona, the Department of Administration put out some new employment forecasts for 2014 and 2015 indicating more of the same.

Arizona Snapshot:

The Arizona Department of Administration put out new employment forecasts for 2014 and 2015. They now estimate that the state will add 53,500 jobs this year (a 2.1% gain) and 60,400 next (a 2.4% gain). Last year, the state added 51,700 jobs (a gain of 2.1%).

The home ownership rate in the state continued to decline and stood at 64.8% in the first quarter compared to 66.8% in the first quarter of last year. In Greater Phoenix, the homeownership rate was 63.2% compared to 63.7% a year ago. In Tucson, the rate was 66.3% compared to 65.5% last year.

According to CBRE, vacancy rates in the Greater Phoenix office market declined to 22.1% in the first quarter of 2014 as absorption of space exceeded the change in inventory. The same general trend was also true for the Greater Phoenix retail market as vacancy rates declined to 10.0% from 10.9% a year ago.

U.S. Snapshot:

The biggest story was employment. The economy added 288,000 jobs in April. This is above expectations. It was strong due to some improvement in the economy. But, most of the strength came from delays in hiring late last year due to bad weather in the mid-west and east. Remember how weak employment was in December and January? It is still positive, however, and represents the best performance since early 2012.

The unemployment rate dropped from 6.7% in March to 6.3% in April. This was due to a combination of factors such as the increase in employment and the unusually large decline in the participation rate. Last month, 806,000 people dropped out of the labor force either because of retirement of becoming discouraged. The labor force participation rate, at 62.8%, is now the lowest since March of 1978.

Personal income increased by 0.5% in March compared to February and is now 3.4% above a year ago. This is respectable. Disposable personal income in March was 3.3% above a year ago and personal consumption expenditures were up 4.0% over a year ago. The saving rate fell.

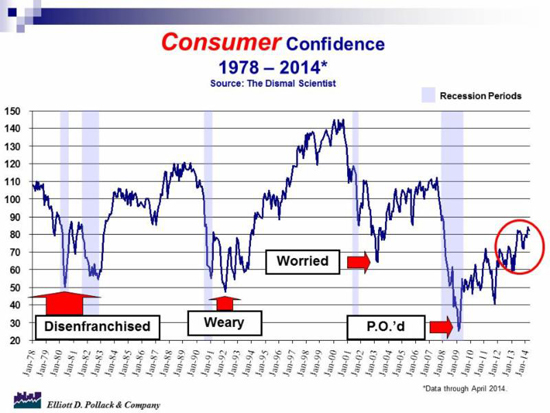

Consumer confidence was about flat in April at 82.3 compared to 83.9 last month (see chart below). A year ago, it was 69.0.

The ISM Manufacturing Index continued to show expansion in manufacturing. The index in April was 54.9 compared to March’s 53.7. Any reading of 50 or above indicates expansion in the manufacturing sector.

New orders for durable goods were up a strong 9.6% over a year ago.

The National Association of Realtors home sales index was up in March to 97.4. While this was up from 94.2 in February, it is still down from last year’s 105.7.