The Monday Morning Quarterback / A quick analysis of important economic data released over the past week

Elliot D. Pollack & Co.

The economy seems to be gaining steam. Normally, the question would be how soon the Fed will tap the breaks. But, times are not normal. Not only is the recovery subpar for this point in the cycle, but, the Fed can’t even be sure what some of the historically reliable data means. For example, while employment growth has been steady, it has been lower than one would expect. On the other hand, the unemployment rate is down almost four full percentage points from the 10% peak. It is approaching levels that have historically been associated with some tightening in labor markets. Yet, given the huge drop in the labor force participation rate, it may not be giving that signal now. How many of those who are discouraged will come back to the job market as jobs become more plentiful? How many underemployed will be able to find full time and/or better jobs? On the other hand, has the labor force participation rate been permanently lowered because there are so many incentives (unemployment benefit extensions, easier qualification for other welfare benefits, and social acceptability of being on the dole) not to work? Until the Fed has a clearer picture, it is not likely to move quickly to take the punch bowl away.

U.S. Snapshot:

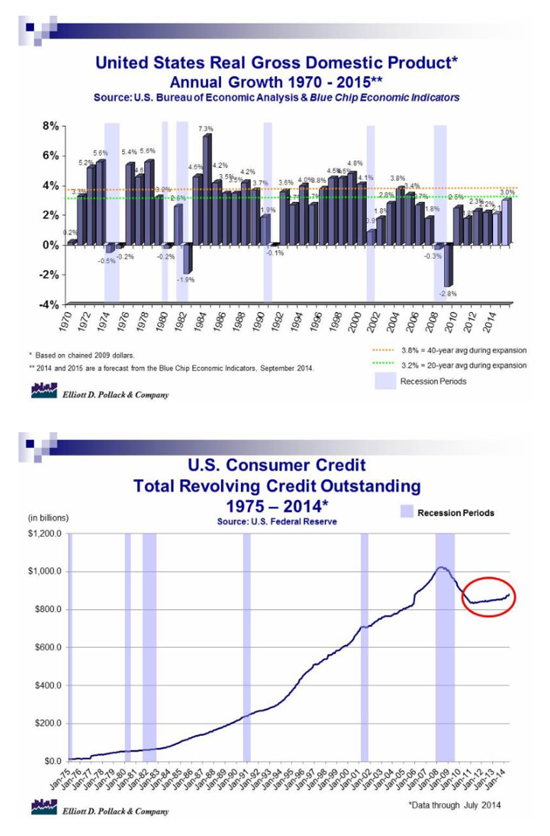

The Blue Chip consensus forecast for U.S. economic growth and inflation for the second half of 2014 and 2015 has changed very little. The forecast indicates that inflation adjusted (real) GDP will grow by about 3.0% in the second half of 2014 and in 2015. This would be the best showing of the cycle and the strongest year over year economic growth since 2005 (see chart below). It is still below normal for this point in the cycle. The CPI is expected to remain in the vicinity of 2.0% through 2015.

Consumer sentiment, as measured by the University of Michigan consumer sentiment index, climbed to 84.6 vs. 82.5 in August. This was the strongest reading in the index since July 2007. The gain was centered in the expectations component of the survey.

Retail sales were up 0.6% in August over July on a seasonally adjusted basis. They now stand 4.8% over a year ago. This is a strong performance. Excluding autos, sales gained 0.3% in both July and August.

Consumers have been drawing on credit lines including a rare and strong rise in credit card usage in July. Consumer credit jumped a large 0.8% ($26.0 billion) in July on top of an upwardly revised 0.6% ($18.8 billion) jump in June. It is revolving credit, the component where credit cards are tracked, that especially stands out in the July report. It grew very rapidly and now stands 7.4% over year earlier levels. As can be seen in the chart below, this component of credit had been stubbornly flat throughout the recovery as consumers continued to get their financial houses in order. We may now be seeing a change in that sentiment. IF THIS CONTINUES, IT WILL SIGNAL A MAJOR SHIFT IN CONSUMER SENTIMENT AND COULD FORCE THE FED TO RECONSIDER CURRENT POLICY. The non-revolving component, as usual, was very strong. Non-revolving credit now stands 10.6% above year earlier levels and was up 0.9% for the month. The biggest gains were in auto loans.

Inventories continue to be in line with sales. The Inventories/sales ratio remains at a low 1.16.

30 year fixed rate mortgage rates according to Freddie Mac averaged 4.12% for the week ending September 11th. Thus, mortgage rates continue to be flat at a low level. Rates are down almost 10% from year earlier levels.

Arizona Snapshot:

Both enplanements and deplanements at Sky Harbor were strong in July. Enplanements were up 5.6% and deplanements were up 5.8%. A total of 3.7 million passengers went through the airport in July.

Total listings in Greater Phoenix were 26,138 in August. This is up 21.9% from year earlier levels. Total sales, according to ARMLS, were 6,431, down 8.8% from a year ago. The result is a 4.1 months supply of homes. This is up from 3.0 months a year ago. The median price of a single family home sold in August was $211,900, up 8.1% from a year ago.