The Monday Morning Quarterback /A quick analysis of important economic data released over the past week

Elliot D. Pollack & Co.

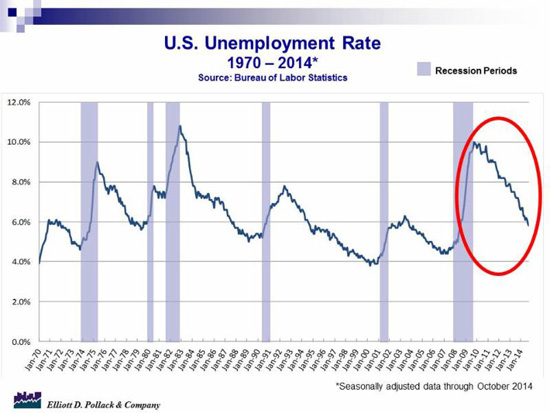

More good news. The national unemployment rate dropped to 5.8% from 5.9% last month. But, the labor force participation rate dropped from 62.8% to 62.7%. The drop in the unemployment rate from the peak has been mimicked by a drop in the participation rate (see the charts below). In fact, if the unemployment rate were adjusted for the decline in participation rate, the unemployment rate would be over 10%. That wouldn’t be completely accurate, however, because a good deal of the decline is due to demographic causes (the retirement of the post war baby boom population). Even so, the unemployment rate compared to normal times is probably understated by 3/4 of 1% or so. That would leave the real level of unemployment is closer to the mid 6% range. Still, things are improving.

U.S. Snapshot

U.S. payrolls grew modestly in October. Non-farm payrolls grew a seasonally adjusted 214,000 last month. The October gain in payrolls fell short of the 235,000 median forecast. The number is still a positive.

Consumer credit outstanding rose $15.9 billion (or 0.5%) in September, right in line with expectations. Once again, the gain was greatly skewed to non-revolving credit which rose $14.5 billion on the strength of auto loans and student loans. The revolving side rose only $1.4 billion.

Sales of cars and light trucks firmed very slightly in October to a 16.35 million annual pace vs. 16.33 million in September. Sales were 6.5% above a year ago.

Manufacturers’ new orders for durable goods declined 1.1% from last month and now stand 3.5% over a year ago. Yet, economic activity in the manufacturing sector expanded in October for the 17th consecutive month and the overall economy grew for the 65th consecutive month according the ISM Manufacturing Index. The index now stands at 59.0% compared to 56.6% in September and 56.6% a year ago.

In September, construction spending unexpectedly declined on public outlays and somewhat on the private nonresidential component. Private residential spending was a positive for the month. Overall, construction spending declined 0.4% in September after a 0.5% decrease in August.

Arizona Snapshot

According to the Greater Phoenix multiple listing service, the median price of a home sold in October was $193,000. This is down from $194,000 in September and up from $185,000 a year ago.

October monthly foreclosure activity in Maricopa County increased slightly to 843 compared to 834 in September but is down from 1,226 a year ago.

The number of residential REO properties in Maricopa County in October was 2,217 compared to 3,155 a year ago. That’s a 29.7% decline.