By Steve Matthews | Bloomberg Business

-

Record home values from Charlotte to Dallas to San Francisco

-

Recovery helps offset stock market losses, aids consumers

In March 2014, Steven and Bernadette Doherty paid $183,000 for a two-bedroom home in Charlotte, North Carolina, $6,000 more than its appraised value. Today, similar houses in the neighborhood are being priced at $300,000 or more.

“We bought at the right time,” said Bernadette, a retired Wells Fargo & Co. information technology worker. “In retrospect, we were lucky as prices have gone up so much more.”

Home-price appreciation is a welcome development for households whose nest eggs were shattered by the residential real-estate bust that began a decade ago.

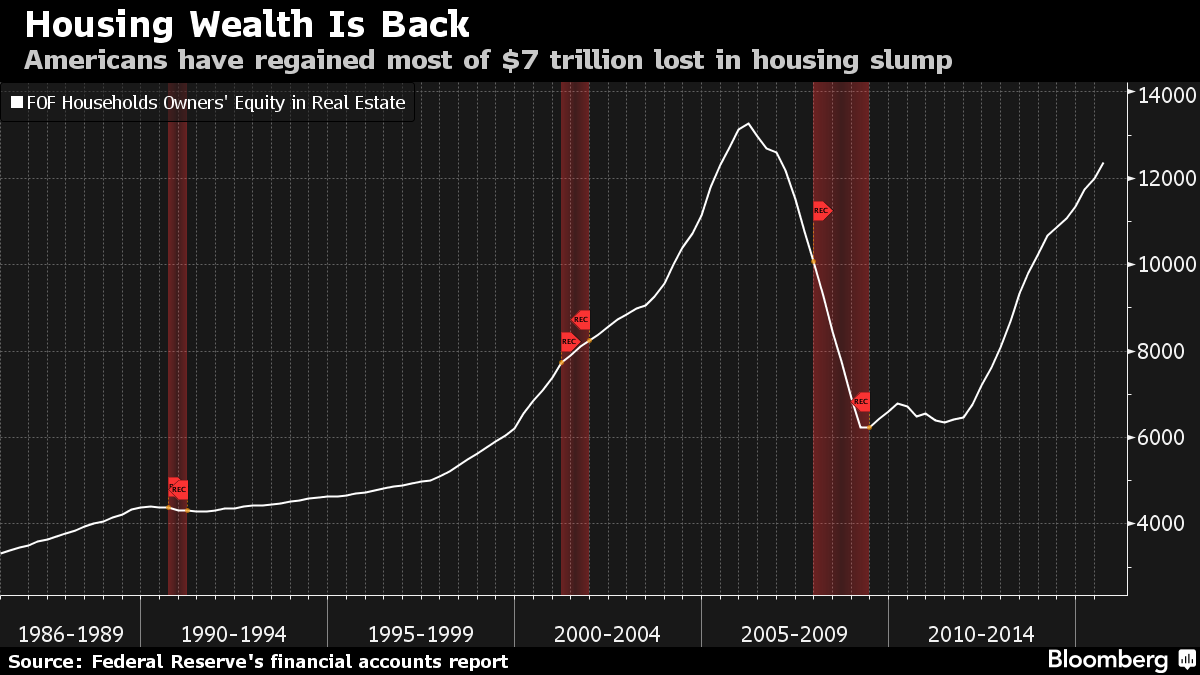

The 2006-2009 housing slump reduced wealth by $7 trillion. Since then, the value of homeowners’ equity in real estate has almost doubled from a low in the first quarter of 2009, Federal Reserve data show. What’s more, housing wealth is poised to reach a new record as early as the second quarter, say economists at the Federal Reserve Bank of St. Louis and Pantheon Macroeconomics Ltd.