(Editor’s note: News releases are published unedited unless they contain factual errors.)

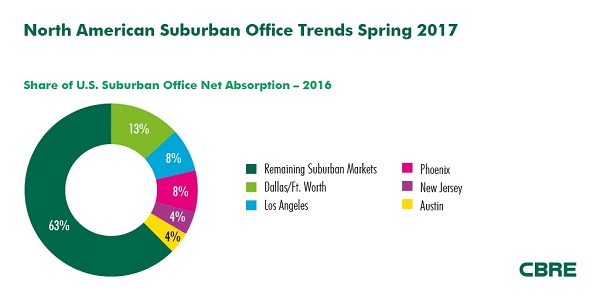

Phoenix Suburbs Accounted for 8% of U.S. Suburban Office Absorption in 2016, Second-Most Among U.S. Suburban Markets

PHOENIX – April 11, 2017 – With the migration of many millennials to urban environments, some commercial real estate industry observers are less than bullish when it comes to suburban office product. However, the so-called “downfall of the suburban office sector” may be highly exaggerated, according to a new report from CBRE Group, Inc. that shows the U.S. suburban vacancy rate to be near a pre-recession low.

“Since the end of the Great Recession, the U.S. suburban office market has tightened at a steady clip, boosted by improving demand and low overall levels of new supply compared with previous cycles,” said Andrea Cross, America’s head of office research, CBRE. “Still, the suburbs are having a hard time shaking the perception that they’re struggling to keep up with the allure of vibrant downtowns.”

CBRE’s analysis shows the U.S. suburban market strengthening in comparison to downtowns. While the downtown market is still out-performing the suburbs by some metrics, the gap in vacancy is shrinking in many markets across the country; the suburban vacancy rate is still 340 basis points (bps) more than the downtown vacancy rate, but it’s a significant improvement over the long-run average gap of 430 bps since 2000.

The suburban vacancy rate has not increased for 27 consecutive quarters through Q4 2016 and stands at 14.1 percent—450 bps below the cyclical peak of 18.6 percent in Q2 2010. The vacancy rate is now just 20 bps above the previous low of 13.9 percent in Q2 2007. The suburban market has registered positive absorption for 27 consecutive quarters as well, underscoring its consistent improvement since early 2010.

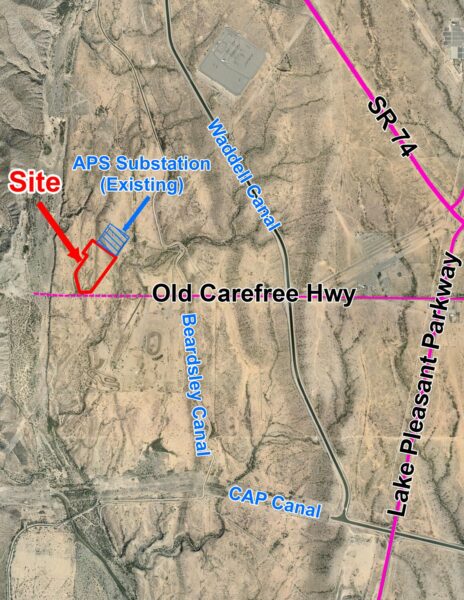

Among the 58 suburban markets tracked by CBRE Research, 50 markets recorded positive absorption in 2016, including 15 with more than 1 million sq. ft. of absorption. The Dallas/Ft. Worth suburbs alone accounted for 13 percent of suburban absorption and 11 percent of total office absorption among the U.S. metros tracked by CBRE Research. Phoenix accounted for 8 percent of suburban absorption in 2016, tied for second most with Los Angeles. Many markets that have lagged during the current expansion due to particularly severe housing busts, overbuilding or other factors—including multiple Florida markets, Detroit, Milwaukee, Phoenix, Long Island, Inland Empire and Los Angeles—posted year-over-year vacancy rate decreases of 200 bps or more in Q4 2016. Phoenix’s suburban office market recorded a decrease of 230 bps, ranking among the top markets for largest year-over-year decreases.

“Unlike its peers, ,” said Kevin Calihan, a corporate office specialist with CBRE’s Phoenix office. “

Downtown Phoenix’s profile is improving as suburban office rents increase and users look to downtown’s affordability and growing amenities.

“Although suburban office growth is expected to moderate in the next few years, we believe the market still has further room to run. Many suburban markets are positioned for further occupancy and rent gains due to continued demand and lack of available supply, especially newer, high-quality product,” said Ms. Cross.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (based on 2016 revenue). The company has more than 75,000 employees (excluding affiliates), and serves real estate investors and occupiers through approximately 450 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.