ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

October 9th, 2018

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

Apparently, the markets believe that the economy will continue on its present roll. The yield on the 10-year U.S. Treasury increased to 3.23% on Friday. That’s up from 3.05% a week earlier. The yield on 90-day treasury bills increased to 2.23% as of last Friday. That was up from 2.19% a week ago. The increase at the long end of the spectrum suggests that people believe that the economy will continue to be strong enough long enough to cause an increase in demand for long term debt relative to short term debt. This is a good sign. If markets were discounting a recession, the yield curve would be moving toward a negative slope (short term rates higher than long term rates). That is not the case. This is another good sign.

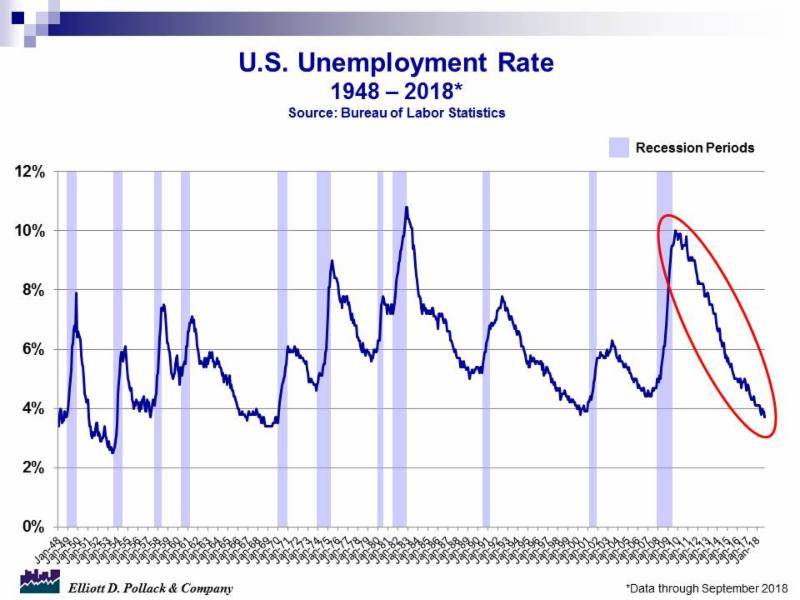

Over the last week, new data showed a continued decline in the unemployment rate (this can’t go on forever but it apparently can for a while). In addition, a total of 134,000 new jobs were created in September. While this is less than the average monthly gain of 201,000 over the past 12 months, it is still positive. Wages are now moving up more rapidly than inflation. The ISM manufacturing index continues to be highly positive as did new orders for manufactured goods. A solid labor market had resulted in a pickup in consumer credit. And auto sales remained strong.

In Greater Phoenix, the resale housing market remained solid. Active listings in September were 6.9% below year earlier levels. Prices continue to rise on a year over year basis. And average days on market remained low. Overall, another great week economically.

U.S. Snapshot:

-

Total nonfarm payroll employment continued to increase in September. Although, the monthly increase of 134,000 is the lowest increase of 2018 and well below the 12-month moving average monthly gain of 201,000, it was enough to push the unemployment rate to its lowest level since 1969 (3.7%). This is down from 3.9% in August and 4.2% from a year ago (see chart below).

-

Growth in the manufacturing sector continued in September according to ISM. The manufacturing index (59.8) was down from 61.3 in August and 60.2 from a year ago. But any number above 50 indicates growth in the sector.

-

The non-manufacturing sector also increased in September (61.6) compared to August’s reading of 58.5 and 59.4 from a year ago. Any number above 50 indicates growth in the sector.

-

U.S. light vehicle sales were at a seasonally adjusted rate of 17.4 million units in September. They were up 4.5% from the August rate of 16.6 million units.

-

New orders for manufactured goods in August increased 10.0% above a year ago. Inventories continue to be under control as the inventories to shipment ratio dropped to 1.34 from 1.35 in July and 1.37 a year ago.

-

Consumer credit increased to $20.1 billion in August, up 0.5% from July and 4.7% from a year ago. The majority of the increase, $15.2 billion, came from non-revolving credit (auto loans and student debt) while $4.8 billion was in the form of revolving credit.

Arizona Snapshot:

-

The Greater Phoenix resale housing market continues to tighten in September. Both active listings (-6.9%) and average days on market (-6.0%) decreased from a year ago. The median sales price increased by 7.2%.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200