The Monday Morning Quarterback

ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

March 18th, 2019

A quick analysis of important economic data released over the last week

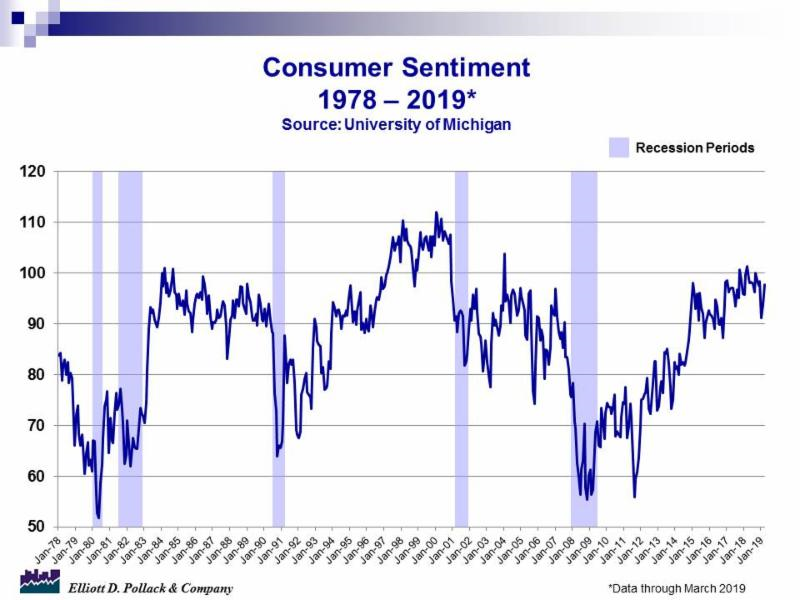

The economy continues to expand, albeit at a decelerating rate, and the near-term outlook remains positive. The number of job openings now exceeds 7.5 million. This is far more than the total number of unemployed. The consumer sentiment index has, for the most part, recovered from what it lost during the government shutdown in December and January. Retail and food sales increased after a monthly decline in December. Consumer prices remain under control. Industrial production inched up as did construction spending. But, home sales were anemic.

Most importantly, though, is that the many indicators we follow to determine where we are in the business cycle still seem to be telling us that the economy is late in the cycle but that no recession is imminent.

So, while nothing lasts forever, by summer the current upcycle is going to become the longest in the more than 240 years we have been a nation. Not bad.

U.S. Snapshot:

The University of Michigan’s consumer sentiment index rose to 97.8 in March. This compares to 93.8 in February and 101.4 a year ago (see chart below). All income groups were more positive about the prospects for growth in the economy overall.

There was little change to the number of unfilled jobs (7.6 million) in January. This compares to almost 6.6 million jobs that went unfilled a year ago and 7.5 million that were open in December. The annual number of hires (68.9 million) and quits (40.1 million) were up in 2018 over 2017. The annual number of layoffs and discharges (21.9 million) edged up in 2018.

Retail sales in January (seasonally adjusted) were up 0.2% from December and 2.3% from year earlier levels.

The total value of distributive trade sales and manufacturers’ shipments for December were down 1.0% from November but were up 2.1% from year earlier levels. The inventories to sales ratio increased to 1.38 from 1.36 in November and 1.34 a year ago.

The consumer price index for all urban consumers (CPI-U) increased 0.2% in February and stood 1.5% over year earlier levels. The index less food and energy was up 0.1% for the month and stood 2.1% above a year ago.

Industrial production increased 0.1% in February and now stands 3.5% over a year ago (see chart below).

Sales of new single-family houses in January were down 6.9% from December and were down 4.1% from year earlier levels. The median sales price was $317,200.

Arizona Snapshot:

Taxable retail sales in the stale were up 4.9% in January compared to year earlier levels.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200