ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

June 3rd, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

The big news last week was President Trump’s threat to impose substantial tariffs on Mexico until they helped stem the migrant surge. This was deemed by the President to be a national security issue. Such an increase in tariffs, starting next week at 5% and ratcheting up to 25% by October, would clearly hurt consumers. We are Mexico’s largest buyer of export goods. Export goods account for 37% of economic activity in Mexico. Thus, such tariffs would be quite painful for Mexico.

In the U.S., prices of goods we import from Mexico would be affected. Of the $346.5 billion we imported from Mexico last year, $93 billion was comprised of vehicles, $64 billion was electrical machinery, $16 billion was mineral fuels, $15 billion was optical and musical instruments and $26 billion was agricultural products. If this issue is not quickly resolved, consumers would pay the price. Car manufacturers would feel the majority of the impact, but, all the above categories would feel the impact of higher prices.

Obviously, if consumers were paying more for these products, there would be less left to spend on other products. In addition, it would be a transfer of wealth to the government who gets the higher tariffs and domestic companies who produce competitive products to those products whose prices would be higher. In effect, those companies could raise prices because their Mexican competition would have higher prices.

We are now dealing with tariff issues on two fronts. China and now Mexico. Hopefully, both are resolved quickly. While these issues are not likely to throw the economy into a recession, they could slow the economy internationally and domestically. In Arizona, about 90,000 jobs are related to trade. We are adding about 80,000 total jobs a year at this point. Even if the state lost 10-20% of those trade jobs (an unlikely high number), the state will still grow. Keep your eyes on this one.

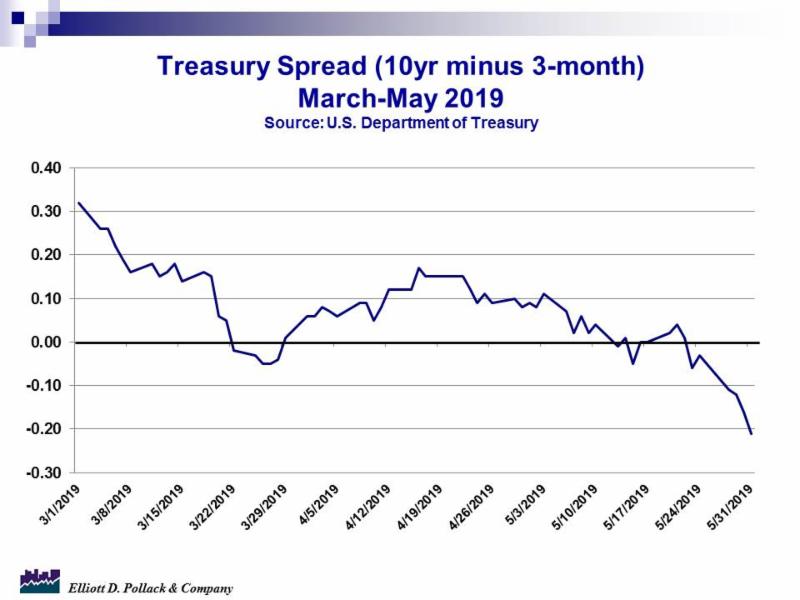

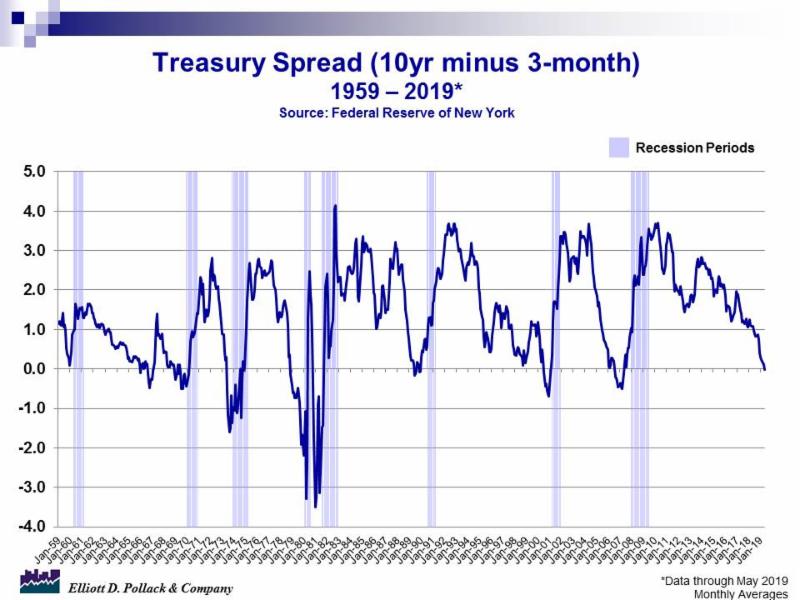

Other data was generally positive. Personal income was up. Both major measures of consumer confidence increased. Home prices increased by at a slower rate from a year ago. And pending home sales were modestly down. On the other hand, the yield curve, as measured by the 10-year vs. the 3-month treasury spread, has been flat to down for almost three weeks (see charts below). Historically, when the spread is negative for more than a month, a recession is likely to occur sometime within the next 24 months.

U.S. Snapshot:

Personal income increased 0.5% in April when compared to March. It now stands 3.9% above year earlier levels. Disposable personal income was up 0.4% for the month and stands 3.8% over a year ago. Personal consumption expenditures were up 0.3% from March and 4.3% above a year ago.

Both major measures of consumer confidence were up in May. The Conference Board Consumer Confidence Index rose to 134.1 in May. That’s up from 129.2 in April and 128.8 a year ago. The University of Michigan Consumer Sentiment index rose to 100.0 in May. That compares to 97.2 in April and 98.0 a year ago.

The S&P/Case-Shiller 20-City Composite home price index rose 0.7% over the February reading in March. The index is now 2.7% higher than it was a year ago.

According to the National Association of Realtors, pending home sales declined modestly in April. The index fell to 104.3 in April compared to 105.9 in March and 106.4 a year ago. Though the latest monthly reading showed a mild decline in contract signings, mortgage applications and consumer confidence have been steadily rising.

Arizona Snapshot:

Activity at Sky Harbor International Airport continued strong in April. Total activity was up 3.5% from a year ago.

The Greater Phoenix S&P/Case-Shiller home price index increased 0.4% in March compared to February and was up 6.1% from year earlier levels.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200