FOR IMMEDIATE RELEASE

March 23, 2020

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

WHAT WILL THE OTHER SIDE LOOK LIKE?

It’s been a week since I wrote the last MMQ. It seems like a lot longer ago than that. The changes that occurred this past week in response to the Coronavirus have really changed the world for most people. The number of Covid-19 cases are still expanding exponentially. Given the incubation period and the time it takes to test after the symptoms become clear, the best case is that it will be two or more weeks before the number of new cases reported daily will begin to slow (the total number of cases will probably still be increasing for a while longer). But, hopefully we will reach an inflection point where the number of new cases begins to slow. By then, the total number of cases will be a significant multiple of what we have now.

It is uncertain how long social distancing, home isolation of those with the virus, the household quarantine of their families and the closure of schools and universities combined with the closure of most nonessential businesses in various states and cities will lead to the needed results. Given that so far many, but certainly not all, have tried to comply, there will hopefully be some positive news in terms of a slowdown in the growth in the number of cases. Yet, as long as a significant number don’t comply, it will remain a difficult situation. It’s just that no one knows exactly how difficult yet, but we will know soon. Even then, there will be no resolution soon. This is not a short term problem medically or economically. If you don’t believe me, read up on the Spanish flu epidemic of 1918-1919.

The economic situation is currently ugly. What a change from a few weeks ago when things looked so good. Exactly how ugly things get now depends on not only how quickly the virus is controlled, but also who is covered by the government relief package, the details of which, as of Sunday morning when I am writing this, are still unknown. You will know a lot more than I do now when you are reading this as the package should hopefully be finalized late Monday.

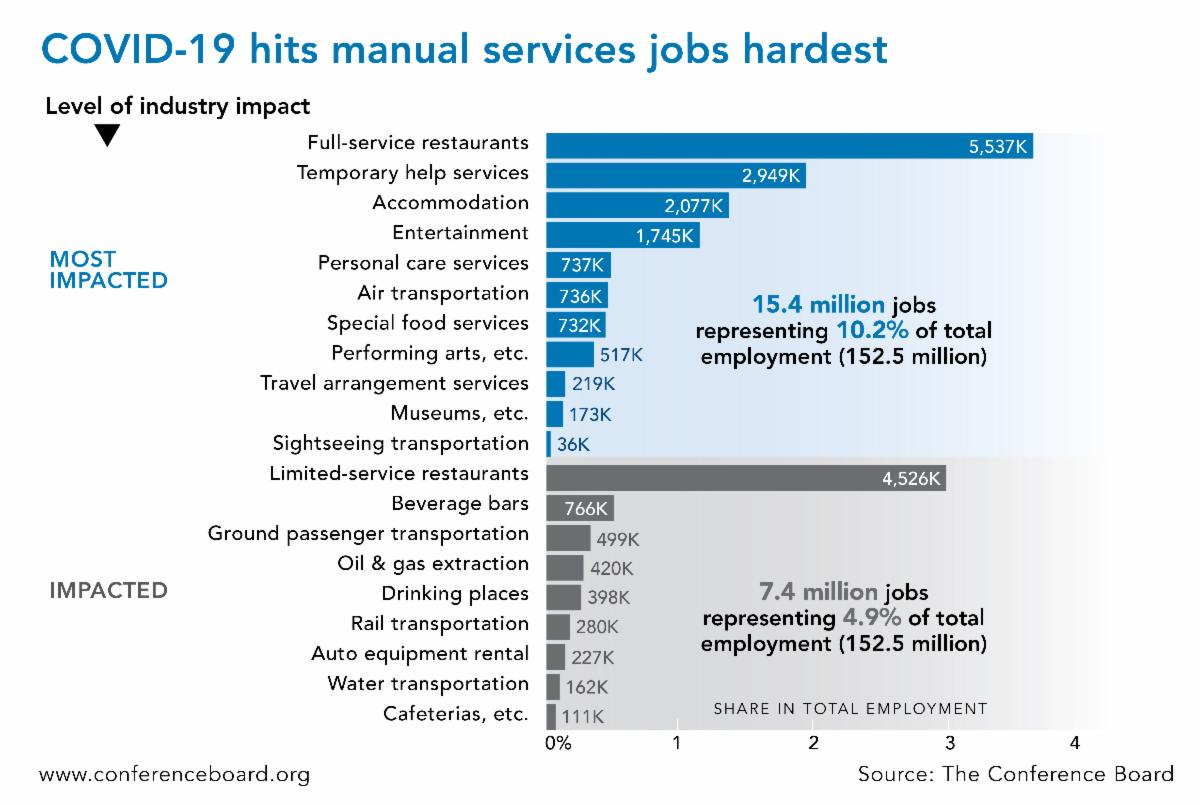

What do we know at this point about the economic issues? According to the Conference Board, employment in the industries “most impacted” and “heavily impacted” account for about 23 million of the 152 million jobs in the U.S. (list shown below). There are obvious omissions such as non-food retail, for example. And, of course, in those states and cities that are on total lockdown and a job does not lend itself to working from home, the numbers will be much higher. And then there are the ripple effects of those workers. So, the total numbers appear to me to be much larger than the Conference Board’s.

In Arizona, Retail Trade and Leisure and Hospitality account for about 22% of direct jobs. Including the ripples effects (indirect and induced jobs), these two categories could account for nearly one-third of the jobs in the state. Given the number of people in those industries that no longer have jobs and are not getting paid, the unemployment figures will sky rocket nationally and in Arizona. Current estimates report the unemployment rate nationally likely going from 3.5% to double digits. This is a massive problem for everyone.

Those who keep their jobs during this period will end up being flush with cash in the other end. This is because they can’t spend very much now that nothing is open. They will be in good shape financially.

This is about those who lost their job. Many of those who no longer have jobs live hand to mouth. Many will not be able to replace their jobs in the near term because employers may not be hiring or the skillset of those laid off may be different from the requirements of available jobs. Unemployment insurance, if you qualify, will replace only some, but not even close to all, of a full salary. The initial proposal of sending out checks for $1,200 or $1,500 to each affected worker does not resolve the problem. Many will burn through a one-time payment quickly. It would delay the problem for a short time but will not fix it. The only way to fix the problem is to increase benefits to a significant percentage of their pre-layoff income with a cap of around $75,000 annually until the pandemic is contained. At least this would allow people to stay afloat and be viable economically at the other end of this.

The object of any program should be to help keep money flowing to workers who have been laid off due the effect of the virus and at the same time help small businesses so jobs are there at the other end. Perhaps giving the money to employers who would cut the checks to the employees would be better than direct pay from the government. Fortunately, the proposal would allow small businesses who use the money for salaries and other direct costs such as rent to not have to repay the loans. So the loans become a subsidy which is more realistic.

Large corporations should only get loans or grants if a major part of it was used to bring back furloughed or other employees who have been let go because of the effect of Coronavirus or keep existing employees from being laid off.

Overall, it is better to keep people “working” than to pay them not to work. It is better to keep as many small businesses, most of whom are in the service, food or retail industry, afloat as long as possible. If congress can do both, that’s the best case. Regardless of the form, if the economy is to return to health quickly once the crisis ends, cash must continue to flow to as many workers as possible.

There is no perfect solution. If people who were laid off run out of money because they couldn’t find a job, things get ugly fast. Many would stop paying rent and stop making debt payments. Who picks that up? And if congress does get people cash they need to ride out this period, how do they deal with the moral hazards and perverse incentives created?

That being said, the only solution that keeps the outlook for the other end of this positive is to subsidize a meaningful part of pre-layoff income. As an economist, I see the one-time payment as not doing the job. I hate to say this because the moral hazards are so great. But, given the circumstances, I see no other viable solution as long as the subsidy ends and people can prove they were trying to find jobs. This would allow a much more rapid fix for the economy on the other side of this.

Those who still get paid during the duration of the crisis will, at the end, find themselves with a bunch of money that they saved because circumstances prevented them for spending it. They couldn’t travel, they couldn’t go the restaurants and bars or concerts or retail stores and so on.

Those who lost their source of income and couldn’t replace it would have the opposite problem if they were not subsidized. They would be buried in debt and legal issues and even when they started to work again it would be a long time until their issues got resolved. It’s an ugly picture and would significantly delay the normalization of the economy. If, on the other hand, they go enough to survive, the economy, given all the pent up demand and individuals with high savings rates, would recover rapidly. This is true despite the fact that many Mom and Pop restaurants, bars, retail stores and other small businesses will not reopen. The market will take care of that, though.

Yes, you won’t eat two meals out or go to two movies or two vacations if you couldn’t go on one this year. But, if you need a car, you’ll buy it. And sporting events and concerts will be full. Your favorite restaurant will have a two hour wait. Retail stores will be full and hotels will be difficult to get into. In short, Americans will do what they always do when they are flush. They will spend.

As for the near term, look for initial claims for unemployment insurance to skyrocket this week. Probably by a factor of 8-10. Look for real GDP to be weak in the first quarter and a disaster in the second and perhaps third quarter. Look for unemployment to skyrocket and retail sale to plummet. Look for industrial production to decline and consumer confidence which is driven by jobs to take a big hit. The reality, though, is that what happens when this ends, at least economically, is far more important than how bad the numbers are during the crisis. Those bad numbers should be transitory. It is the shape of the recovery one should focus on.

As for this week’s data, once again most of it doesn’t mean much under current conditions except to show that the economy prior to the virus was doing just fine. Nationally, January job openings were up and at very high levels. Retail sales were strong. Industrial production was at least flat for the year and up for the month. And the housing market was strong. In Arizona, February housing permits in Greater Phoenix were up a whopping 30.5% from last year to 2,238. And resales were up 10.3% from last year to 8,325. Housing permits for February in Greater Tucson were up 21.6% to 321. Once we start receiving more meaningful data (March forward), we will go back to the normal format. Right now, it doesn’t seem worth it to report data that comes from a time that seems so long ago and so far away.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue,

Suite 100

Scottsdale, Arizona

85251

480-423-9200 Website | Twitter

| Facebook