By Jann Swanson | Mortgage News Daily

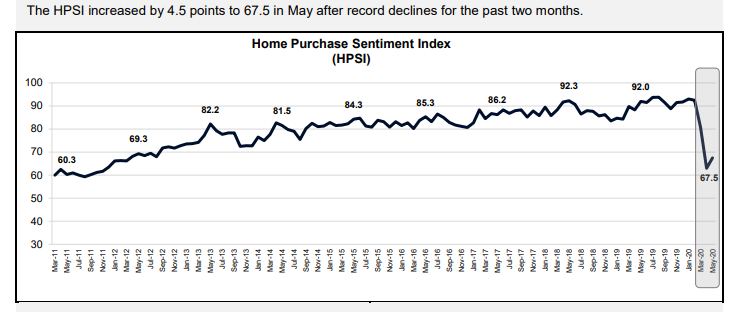

After falling an aggregate of 29.5 points in March and April, Fannie Mae says its Home Purchase Sentiment Index (HPSI) has begun to recover. The Index rose 4.5 points in May to 67.5 from an all-time survey low in April. Four of the six index components gained ground. Year over year, the HPSI is down 24.5 points.

Consumers reported a somewhat more optimistic view of homebuying conditions and, to a lesser extent home-selling conditions, in their responses to the National Housing Survey upon which the index is based. Moreover, fewer consumers reported expectations that mortgage rates will go up over the next 12 months.

“Although the HPSI’s precipitous declines of March and April did not continue in May, Americans’ financial, economic, and housing market concerns remain substantially elevated compared to survey history,” said Doug Duncan, Senior Vice President and Chief Economist. “Low mortgage rates have helped cushion some of the impact of the pandemic on consumer sentiment regarding whether it’s a good time to buy a home, which picked back up this month to late-2018 levels.