ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

June 8, 2020

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

May’s jobs report shows the risks of forecasting something when there’s no history to draw from. The U.S gained 2.5 million jobs in May. This was way higher than the most optimistic expectation. And it occurred despite another large jump in jobless claims. The gains were where one would expect. Leisure and Hospitality as restaurants, bars and hotels began to reopen. Educational and Health services as delayed medical procedures finally got taken care of. Construction as a result of the strong housing market. And Trade, Transportation and Utilities as retail stores also opened to their customers. But, it was the lack of significant declines in other major sectors that was surprising. Only Government (teachers) showed a decline.

Yet, May was still down 17.7 million jobs from a year ago. It will take a few more months of this trend to get us to the point where a reasonable forecast of how long it will take the economy to get back to normal. Given the damage we have talked about in past MMQ’s, it will likely take a while.

Also, while the stated unemployment rate actually declined from 14.7% to 13.3%, there are issues with the data having to do with how people classify themselves. The Bureau of Labor Statistics is still trying to deal with this. We discussed it over the past couple of months. Those workers who were classified in the “other reasons for being unemployed” category by choice probably should have classified as “unemployed on temporary layoff”. This would have increased May’s unemployment rate to above 16%. But, April’s would have been above 19%. So, the unemployment rate still would have declined. The reason for this explanation is that some media outlets (The Washington Post for example) are trying to politicize the classification. I can guarantee you with 100% certainty that there is no politics at the BLS. It is a classification issue that they will work out. Overall, it will take quite a while for the unemployment rate to get back to anywhere near the 3.5% of February. It could, though, get back to 10% or less fairly quickly. Time will tell.

But, as long as unemployment stays elevated, it will be hard to regain previous spending levels..

In addition, as we have noted before, many small and medium sized businesses will simply not reopen. It’s too late and government relief efforts were too slow in getting the money out for some. The number of people unemployed is still at a very high level and some who think they will be recalled soon are in for an unpleasant surprise. Supply chains have suffered some unusual strains and will take a while to repair. And, some businesses that received PPP loans will not be able to exist without it once the money runs out.

Bankers, despite what the FED is trying to do, have tightened loan standards. This is true not only for housing, but, standards for auto loans are the highest in a decade. On the business side, 40% of commercial and industrial lenders tightened their standards. That’s a very large number. It reflects the fact that some large companies are in or will go into bankruptcy. This could take a while (years) to resolve. In addition, until a vaccine is found or something is discovered that mitigates the impact of COVID-19, social distancing will continue. This will limit the number of people who can be served at a restaurant or retail store or bar or hotel.

On the other hand, the May employment figures are impressive. It shows that the underlying strength of the U.S. economy that existed in February is still around. So, while it will take a couple of more months to determine where we really are, this month’s employment data is some long awaited good news.

As for weekly data, seated diners at restaurants in the state and in Greater Phoenix improved. But, for the week of May 30, the state was still 54.6% below a year ago. For the week of May 21, it was down 68%. In Greater Phoenix, the numbers were down 64.2% from a year ago for the week of May 30 compared to 76.1% from a year ago for the week of May 21. So, while it’s still down a lot from last year, it is at least moving in the right direction.

The improvement in hotel occupancy has been less impressive. Occupancy rates in the U.S. as a whole were 36.6% for the week of May 30. That’s down 48.6% from year ago levels. Last week, the occupancy rates were down 50.0% from a year ago. Slowly moving in the right direction are trends in mobility to the workplace (down 33.6% for the week of May 23 compared to down 36.1% from a year ago for the week of May 16 for the state) and mobility to retail and recreation places (down 19.7% for the state for the week of May 23rd compared to down 25.9% for the week of May 16th).

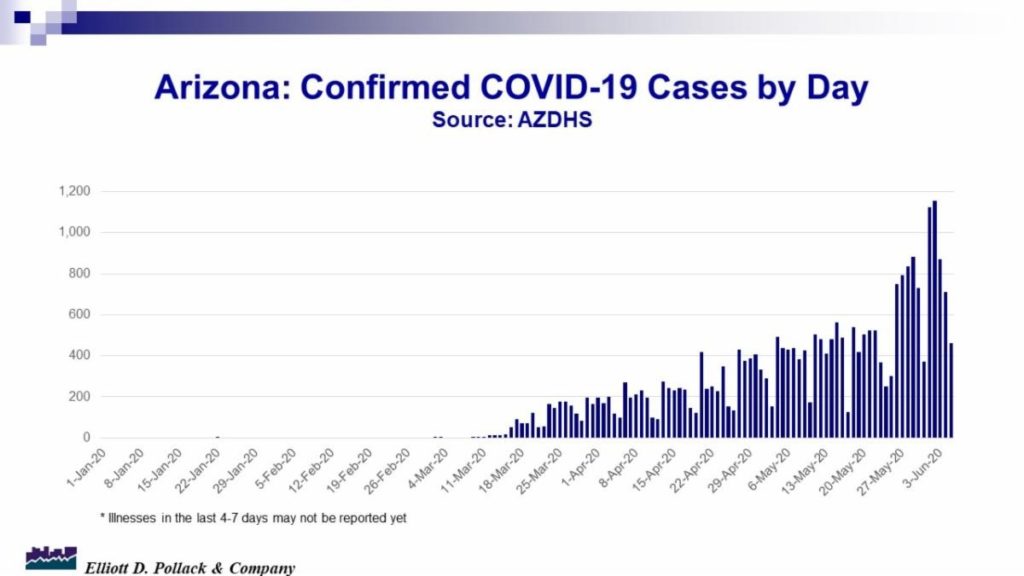

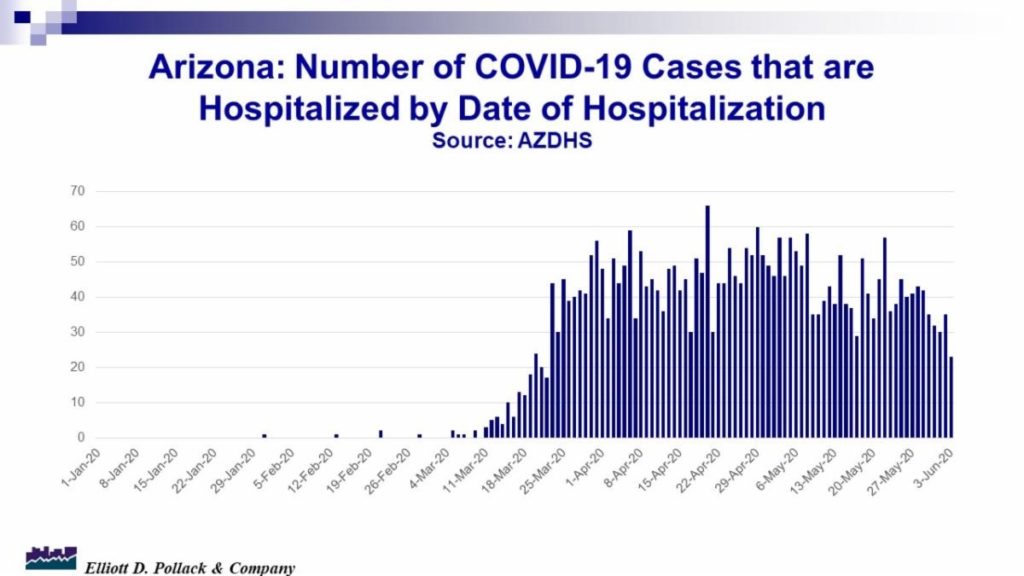

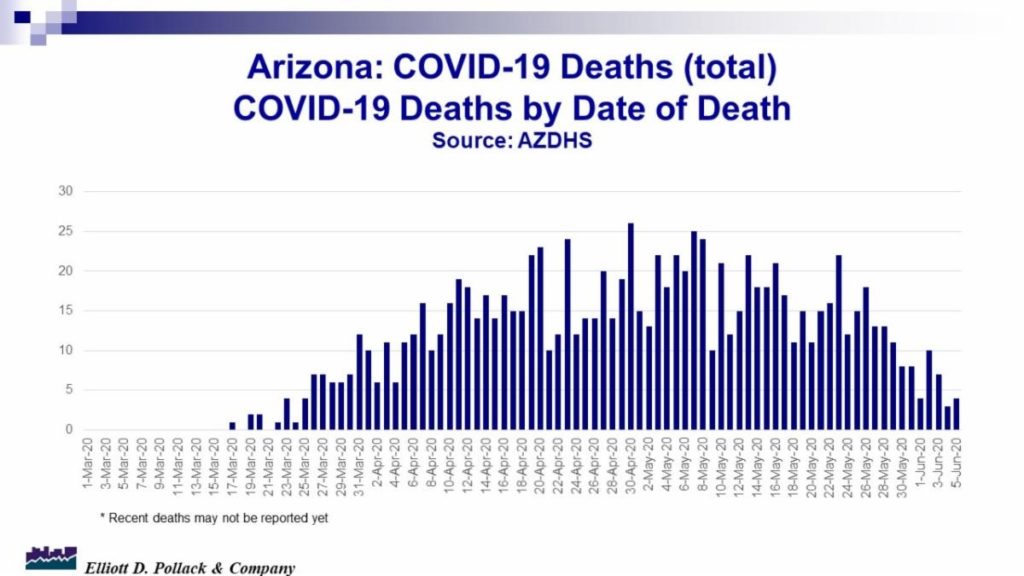

Facts related to COVID-19 are mixed. The number of new cases since the State has re-opened have increased. The number of deaths, though, remains low as does hospitalization for COVID-19. Keep your eyes on these numbers. Also, while the number of initial claims for unemployment insurance is still very high, it too is making some progress. Overall, it continues to look like a long and winding road. At least there signs of improvement.

This week’s data is like the Clint Eastwood movie. The Good, The Bad and The Ugly. Some is very positive, some is not, and some is transitional meaning that it’s too early to say if it should be ignored or not. So, the best thing to do with the transitional info is to ignore it for now.

U.S. Snapshot:

THE Good

• As discussed above, the employment data for May was much better than expected. Total nonfarm payroll employment rose by 2.5 million and the unemployment rate declined to 13.3%. The unemployment rate declined by 1.4 percentage points and the number of unemployed persons fell by 2.1 million. Even with this, the unemployment rate and the number of unemployed persons are up by 9.8 percentage points and 15.2 million, respectively, since February. If the workers who were recorded as employed but not at work for the entire survey reference week had been classified as “unemployed on temporary layoff,” the overall unemployment rate would have been higher than reported. This kind of exercise would require some assumptions. The Bureau of Labor Statistics is still dealing with the issue of misclassification. Either way, however, the unemployment rate in May would have been well below April’s figure. It appears that May marked the beginning of the long road back for labor markets.

• Total construction spending in April declined 2.9% from March but was up 3.0% from a year ago.

THE BAD

• Initial claims for unemployment insurance are still increasing at a declining rate. Initial claims were up 1,877,000 for the week of May 30th. While that’s down from the 2,126,000 initial claims for the week of May 23rd, it’s still 753% above last year’s number.

• The May ISM non-manufacturing index rose to 45.4. That’s up from 41.8 in April but down from 56.3 a year ago. Any reading of less than 50 suggests that the non-manufacturing sector is in a recession. And four of the five subindexes continue to be negatively impacted by the COVID-19 pandemic.

• The May ISM Manufacturing index was 43.1 compared to April’s 41.6. Again, any reading below 50 suggests the manufacturing sector is in a recession. A year ago, the index stood at 52.3.

THE UGLY

• Manufacturers’ new orders in April stood 22.3% below year earlier levels and were down 13% for the month. Durable goods orders were down 29.8% from a year ago and were down 17.7% from March. Hopefully, April will mark the low point in the manufacturing sector.

• Consumer credit contracted by 19.6% (annual rate) from year earlier levels in April. Revolving credit fell at a 64.9% (annual rate) in April while non-revolving credit fell at a 4.9% (annual rate). The key takeaway is that banks and finance companies grew more restrictive in extending credit to individuals in April as job losses and concerns about repayment capabilities mounted. In addition, given the closure of most retail outlets, it was simply more difficult to use your credit card to charge “stuff”. Hopefully, with employment now rising, banks and finance companies will ease the recently toughened restrictions.

Arizona Snapshot:

• Initial claims for unemployment insurance fell to 22,012 persons for the week of May 30th. That’s down from 26,068 from the week of May 23rd. While the state is clearly past the peak in new weekly claims, last week’s number was still 439% above year earlier levels. Since the week of March 21st, 629,715 initial claims have been filed. That represents 21.1% of the March employment number.

• According to the Cromford Report, there were 18,197 homes listed for sale in the Greater Phoenix area in May. This is down slightly from April but 19.4% lower than year earlier levels. This indicates that the resale market continues to tighten. That’s good news for sellers but not good news for buyers.

• Total monthly residential resale sales activity in Maricopa county was 6,271 units in May. This is down 6.0% from April levels but down 40.3% from a year ago. New build sales volume was 1,552 in May. That was up 8.9% from April and up 1.1% from year earlier levels. Given current circumstances, the numbers were impressive.

• Monthly foreclosure activity remains low in Maricopa county. May saw 63 residential notices and only 21 residential foreclosures. This compares to 77 residential notices and 11 residential foreclosures in April and 399 and 118 a year ago.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & Company

5111 N. Scottsdale Rd, Suite 202,

Scottsdale, AZ 85250

480-423-9200