Giulia Sagramola/via Twitter

(Disclosure: Rose Law Group represents Ann Siner of My Sister’s Closet and Judge John Buttrick in their litigation efforts against 208.)

Opinion: Proposition 208’s proponents said that it wouldn’t impact small business. A bill passed by the Senate would ensure that it doesn’t.

By Robert Robb | Arizona Republic

On tax policy, state Sen. J.D. Mesnard is as skilled and well-versed a legislator as has been seen in many a decade.

And darn if he isn’t moving through the Legislature a bill that would largely gut Proposition 208’s high income tax rate without running afoul of the state Constitution’s Voter Protection Act.

Proposition 208 imposed a surcharge on incomes over $250,000 for individuals and $500,000 for joint returns. The surcharge would put Arizona’s maximum rate at 8%, one of the highest in the country.

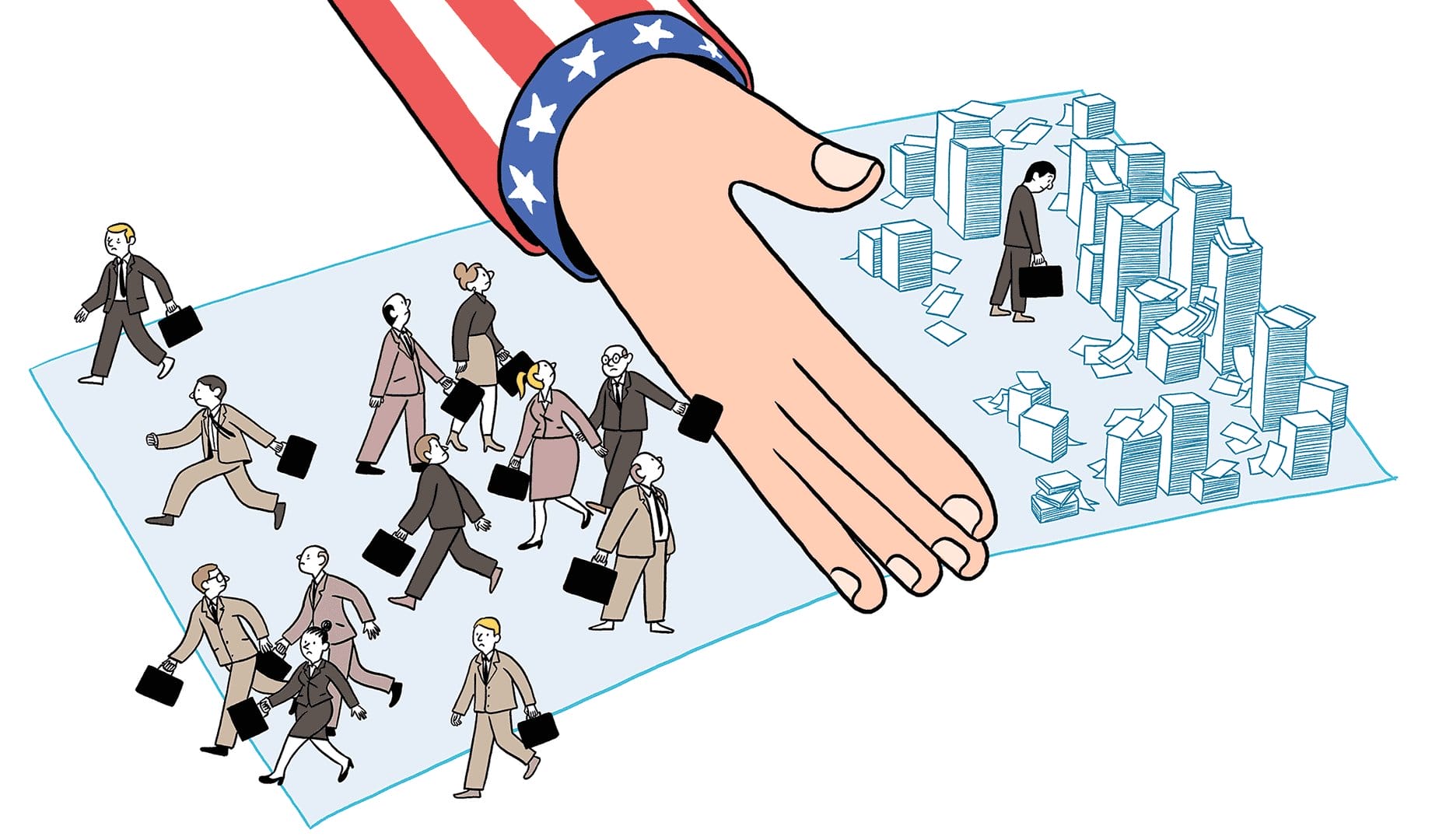

During the campaign, there was a debate about the effect Proposition 208 would have on small businesses. There were distortions on both sides, although consequentially more so by proponents.

A few small businesses would pay high taxes

Most small businesses are what are known as pass-through entities. Their profits aren’t taxed at the corporate level. Instead, they are attributed to the owners, who pay taxes on the profits on their individual tax returns.

These taxes are owed regardless of whether the profits are actually distributed. And often they aren’t. Instead, they are retained for cash flow or investment purposes.