By Madelaine Braggs, Rose Law Group Reporter

The Phoenix housing market may have dodged the prophecies of dooming recession, but after a marathon of rate increases, a peak in inflation, and rapidly increasing population, the demand for affordable housing is growing louder.

At the annual AZ Dealmakers conference, Ali Wolf, Chief Economist at Zonda, says last year was certainly “rotten” for the housing market, it was actually better than expected. The year started with an unemployment rate at 3.4% and the year ended at 3.7%, which continued the longest stretch under 4% since the 1960’s.

Total labor workforce over the year decreased 2.3 million to about 167.5 million, which is still 2% above the pre-pandemic era. Mortgage rates are the beginning of the year were hovering around 6.3%, which was a tough pill to swallow for buyers who compare with those who nabbed 3-4% rates in 2020. The 2023 rates climbed to 8% by mid October, but dropped to 6.6% just before the new year and while the inflation rate was at 6.3% last January, it dropped 51% to 3.1%.

So now that the market is no longer overheating, are buyers ready to jump back into shopping? Wolf says there’s still apprehension, “A lot of people are staying put. The percent of people moving out to buy a home is at the lowest level its been since 2016.”

But Tim Sullivan, Chief Advisory Officer at Zonda, says the market has elasticity. “Available jobs increase is one of the strongest drivers for buying. Phoenix has always outperformed the nation, partly due to inmigration and affordability but in the last two years prices have gone up so quickly. Plus, with interest rate hikes, we’ve reverted to the mean.”

Builders are also starting to invest in residential areas in the metro’s outskirts and just outside of Maricopa County. According to Sullivan, this sprawl is a response to Arizona’s growth and affordability, creating submarkets in the West Valley and Pinal County. “Without sprawl, you get locked in and prices balloon. That’s not an issue in Arizona,” he said.

However, according to Jordan Rose, Rose Law Group founder and president, one hinderance to building new homes is Arizonas water laws. “We have a well intentioned, but outdated, law that when you build a house you have to show you have 100 years of water, and you can’t take technological advances in consideration – no other state has that law,” she said.

At the peak of the pandemic, Phoenix was an overperforming market and the #1 market where people moved to for a move job, according to research by Bank of America. Currently, Phoenix is considered an average performing market compared to the rest of the nation.

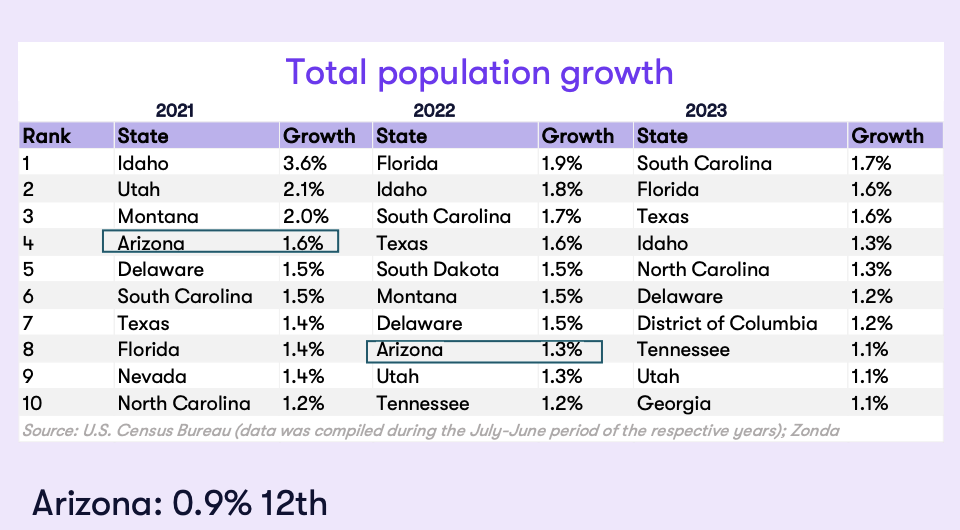

While population growth is slowing down across the state (see above), the rapid increase applied an extreme cost pressure to the Phoenix market, which remains the #1 fastest growing city in America. Data showed 39% of views on listings come from outside the state, with 30% of buyers being cash buyers. Nationally, all cash buyers, who are mostly relocators, are at a 9-year high. Wolf says buyers are also beginning to stretch their budget past 30% of income for smaller homes, compared to a few years ago.

Zonda’s data showed active Phoenix listings are down 5% from 2019, and sellers who have been in their homes for a long period, now looking for a new home, could help add more mobility to housing supply. But investors coming from out of state who are hoping to acquire as many short term rentals as they can, will exacerbate the issue of low inventory for aspiring homeowners.

With a 3% increase in new home prices projected, it seems builders are going to keep these incentive programs as long as it’s needed. “Consumers are searching for deals, and while they’re optimistic on rates, they’re still nervous on price,” said Wolf. “Buyers are looking for discounts, shopping for the lowest rates, and appreciate incentives like money towards closing costs and opportunities to buy down the rate.”

While Phoenix is not immune to the challenges of markets across the nation, Zonda’s survey showed 65% percent of builders say they are on track to meet demand. About 20% say demand is stronger than expected, 13% say demand is slower than they expected, but they’re not worried and less than 10% say demand is so slow they’re worried.

The Phoenix housing market is passed the boiling point, and with both builders and buyers willing to make sacrifices to get to closing, the market is seeing more mobility. But realistically, there’s still work to do at the state legislature to address the larger factors impacting affordability. Further respite would have to come from lower interest rates at the federal level.