By Na Zhao | Eye On Housing

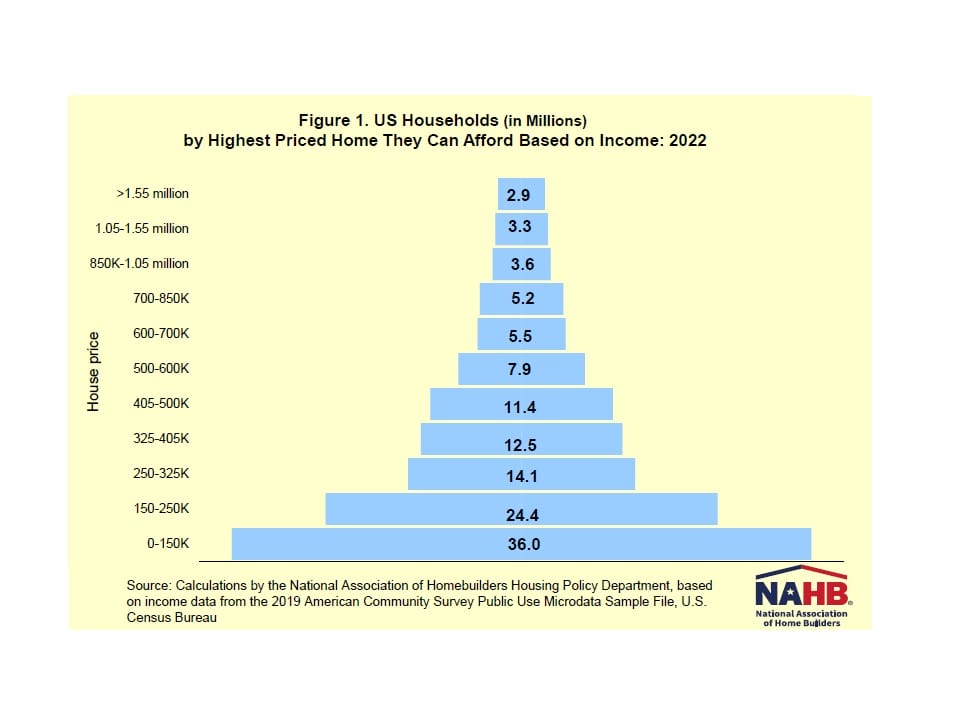

As described in a previous post, NAHB’s recently released its 2022 Priced-Out Estimates, showing that 87.5 million households are not able to afford a median priced new home, and that an additional 117,932 would be priced out if the price goes up by $1,000. A second post showed the households priced out by higher interest rates. This post focuses on the related U.S. housing affordability pyramid, showing how many households have enough income to afford homes at various price thresholds.

The pyramid uses the same standard underwriting criterion as the priced-out estimates to determine affordability: that the sum of mortgage payments, property taxes, homeowners and private mortgage insurance premiums should be no more than 28% of the household income.