‘Not a bad picture,’ says Pollack of economical data

The Monday Morning Quarterback / A quick analysis of important economic data released over the last week

Elliott D. Pollack & Co.

The news on the economy continues to be favorable. As we have said before, this would normally be the boom part of the cycle. The rate of growth is accelerating. There are few obvious imbalances. The rest of the world is increasing stimulus. Not a bad picture. With the exception of construction, the outlook is positive. Overall, growth will continue. Though poor by historic standards, the data is good for what we have seen so far in this cycle.

Arizona Snapshot

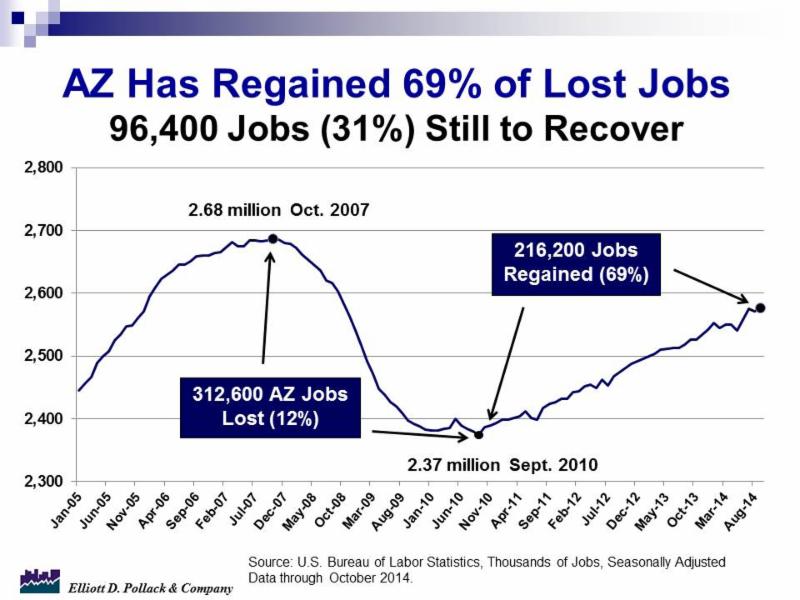

Arizona added 66,400 nonfarm jobs (2.6%) on a year over year basis. This is the strongest gain since January 2007. The private sector gained 63,000 jobs (3.0%) over the year. This was the first time that the private sector reached a year over year growth of 3.0% since 2006. Gains were driven by health care and social assistance, which added 16,500 jobs, the largest year over year gain since records on this sector started in 1991. Large gains were also seen in other sectors including: professional and business services, (15,900 jobs or 4.2%) trade, transportation and utilities (7,300 jobs or 1.5%), and financial activities (6,800 jobs or 3.6%). The construction industry reported a loss (2,400 jobs or -1.9%). The state has regained 69% of the jobs lost in the Great Recession (see chart below).

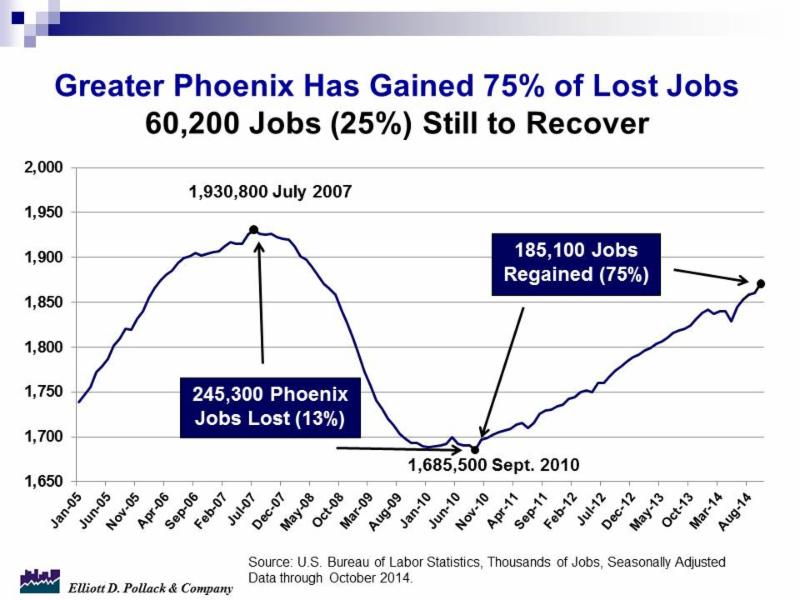

Greater Phoenix gained 53,500 jobs over the last year (2.9%). All sectors except construction were up. Greater Phoenix has regained 75% of the jobs lost in the Great Recession (see chart below).

Greater Tucson gained 6,000 jobs (1.6%) over the past year and has regained only 52% of the jobs lost in the last recession.

The unemployment rate in Arizona dropped from 6.9% in September to 6.8% in October. The unemployment rate in Greater Phoenix in October was 5.7%. In Tucson, it was 6.0%.

New housing permits had an unexpectedly poor performance in October. According to long time housing analyst R.L. Brown, October permits totaled only 710 units. This is the lowest total since January and down from 1,073 a year ago (a 33.8% decline). Year to date new housing permits are down over 17%. R.L.’s latest market letter has an interesting analysis of the new home price vs. existing home price issue.

There were 186 single-family permits issued in Pima County last month. This is a drop of 5.6% from a year ago and a decline of 4.3% on a year to date comparison.

U.S. Snapshot

In October, the index of leading indicators rose a very solid 0.9% pointing to near term acceleration in economic growth. Once again, the largest positive is in interest rates which reflect the Fed’s near zero rate policy. Low unemployment claims and housing permits were strong contributors to strength last month as well.

Overall consumer prices in October were flat after firming 0.1% in September. Analysts projected a 0.1% dip. Excluding food and energy, the CPI gained 0.2%. On a seasonally adjusted basis, the headline CPI was up 1.7% from a year ago.

Industrial production slipped on declines in mining and utilities in October. Industrial production dipped 0.1% after jumping 0.8% in September. Market expectations were for a 0.2% gain.

Overall capacity utilization posted at 78.9% in October versus 79.2% in September and 78.2% a year ago. This is still below levels of capacity that have historically been associated with major increase in spending on plant by business.

Housing starts continue to oscillate. Housing starts declined 2.8% after a 7.8% spike in September. October weakness was in the multifamily component which swings sharply on a monthly basis. The single-family component may be gaining mild strength.

For the first time in a year, existing home sales are now above year earlier levels. Sales rose in October for the second straight month.

Arizona Snapshot

Arizona added 66,400 nonfarm jobs (2.6%) on a year over year basis. This is the strongest gain since January 2007. The private sector gained 63,000 jobs (3.0%) over the year. This was the first time that the private sector reached a year over year growth of 3.0% since 2006. Gains were driven by health care and social assistance, which added 16,500 jobs, the largest year over year gain since records on this sector started in 1991. Large gains were also seen in other sectors including: professional and business services, (15,900 jobs or 4.2%) trade, transportation and utilities (7,300 jobs or 1.5%), and financial activities (6,800 jobs or 3.6%). The construction industry reported a loss (2,400 jobs or -1.9%). The state has regained 69% of the jobs lost in the Great Recession (see chart below).

Greater Phoenix gained 53,500 jobs over the last year (2.9%). All sectors except construction were up. Greater Phoenix has regained 75% of the jobs lost in the Great Recession (see chart below).

Greater Tucson gained 6,000 jobs (1.6%) over the past year and has regained only 52% of the jobs lost in the last recession.

The unemployment rate in Arizona dropped from 6.9% in September to 6.8% in October. The unemployment rate in Greater Phoenix in October was 5.7%. In Tucson, it was 6.0%.

New housing permits had an unexpectedly poor performance in October. According to long time housing analyst R.L. Brown, October permits totaled only 710 units. This is the lowest total since January and down from 1,073 a year ago (a 33.8% decline). Year to date new housing permits are down over 17%. R.L.’s latest market letter has an interesting analysis of the new home price vs. existing home price issue.

There were 186 single-family permits issued in Pima County last month. This is a drop of 5.6% from a year ago and a decline of 4.3% on a year to date comparison.