ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

May 7th, 2018

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

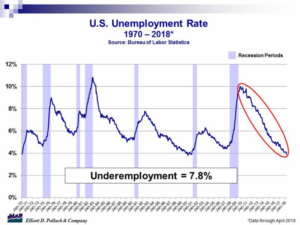

The latest jobs report had some good news, but, it implied some bad news. First, the unemployment rate fell to 3.9%. This is the lowest unemployment rate in more than 16 years. It also is a rate that is associated with being late in the business cycle (See chart below).

With the unemployment rate this low, there are fewer qualified people to fill the jobs that businesses need filled to keep the rate of economic growth high. In addition, since it clearly shows a shift in the demand/supply balance for labor, wages are likely to rise at a faster rate. It will result in higher inflation. That, in turn, will result in the FED continuing to raise interest rates in an attempt to prevent inflation from getting out of line. The ultimate result will be a slowdown in the rate of growth or a recession. This is how business cycles work.

To be sure, there is plenty of steam left in this cycle. But, the environment is now in place for “late in the cycle” stuff to play out. What had been hoped for was that the participation rate, the percent of the population that is in the labor force, which declined rapidly during the last recession, would rise as jobs became easier to obtain and wage growth started to accelerate. So far, that has not happened despite the fact that in today’s world, virtually anyone who wants a job can get one. In the absence an increase in labor participation, we would need to import more skilled labor. Given the political environment in which we currently live, that seems like a long shot.

The bottom line is that the economy continues to do very well. There is a great deal of demand that is likely to keep things going. But, we will be limited in growth due to a tight labor market. Perhaps productivity will pick up. Given the fact that business is likely to try and substitute capital for labor in the short term, that is possible. And while no recession is likely in the short term, we are probably late in the cycle. Let’s see how things play out.

U.S. Snapshot:

-

The unemployment rate declined to 3.9% in April. This is the lowest rate in 16 years (see chart below).

-

Total non-farm payroll employment increased by 164,000 in April. This compares with an average of 191,000 over the past 12 months. Job gains were strong in professional and business services, manufacturing, health care, and government. Over the past year, professional and business services gained 518,000 jobs and manufacturing has gained 245,000 jobs.

-

In April, average hourly earnings for all employees on private nonfarm payrolls rose four cents to $26.84. Over the year, average hourly earnings have increased 67 cents or 2.6%. Private sector production and non-supervisory employees saw an increased five cents to $22.51 on average hourly earnings.

-

During the 1st quarter, non-farm business sector labor productivity increased 0.7%, output increased 2.8% and hours worked increase 2.1%. Over the past year, productivity increase by 1.3%, reflecting a 3.6% increase in output and a 2.1% increase in hours worked.

-

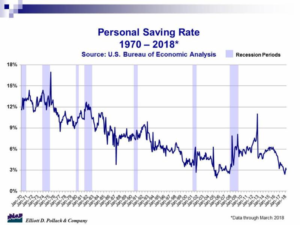

Personal income increased 0.3% in March and now stands 3.6% above year earlier levels. Disposable personal income rose 0.3% for the month and is up 3.7% over a year ago. Personal consumption expenditures were up 0.4% for the month and are up 4.4% over a year ago. As a result, the personal savings rate in the U.S. was down to 3.1%. This is very low by historic standards (see chart below).

-

New orders for manufactured goods in March, up seven of the last eight months, increased by 1.6%. This followed a 1.6% gain in February. New orders now stand a strong 8.1% over a year ago.

-

The ISM’s manufacturing index stood at 57.3 in April. This compares to 59.3 in March and 55.3 a year ago. Any reading of 50 or above suggests that the manufacturing sector is expanding.

-

The ISM’s non-manufacturing index stood at 56.8 in April compared to 58.8 in March and 57.3 a year ago. Again, any reading of 50 or above suggests expansion in the non-manufacturing sector.

-

Construction spending in March was 1.7% below February, but, was up 3.6% from year earlier levels. Private sector construction spending was up 3.9% from a year ago while public sector construction spending was up 3.0% over the same period.

-

Sales of autos and light trucks in April stood at 17.1 million at an annual rate. This compares to a strong 17.4 million in March and 17.0 million a year ago.

Arizona Snapshot:

-

Enplanements at Sky Harbor International Airport in March rose 2.4% over year earlier levels. Deplanements rose 2.2%. Total traffic was up 2.3% over a year ago.

-

Active listings in April in the Greater Phoenix area were down 11.1% from year earlier levels. Average days on the market declined to 64.2 from 73.5 a year ago and 69.2 in March. The median sales price of an existing home sold was $253,000. This was 8.8% above year earlier levels.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200