By Anya Martin | The Wall Street Journal

By Anya Martin | The Wall Street Journal

The buyer is ready to buy, and the seller is ready to sell. Then comes the low blow: The home is appraised below the contract price.

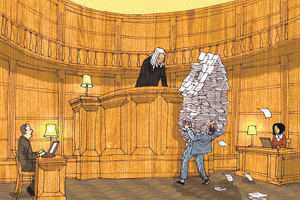

A lower-than-expected appraisal typically means a borrower must come up with a higher down payment or lose the deal, said Allen Cravello, president of American Capital Corp., ACAS 0.00% a mortgage lender and broker in El Segundo, Calif. A possible recourse, albeit one with slim chances, is a formal rebuttal letter, also called a reconsideration letter, prepared by the borrower or loan originator, with input from a real-estate agent or an appraiser.

Evidence of incomplete or inaccurate work can persuade a lender to assign a new appraisal, giving the borrower another chance to qualify at the desired loan amount, said Mathew Carson, a mortgage broker at First Capital Group Inc. in San Francisco who was an appraiser before switching to lending.