By Phil Riske, managing editor | Rose Law Group Reporter

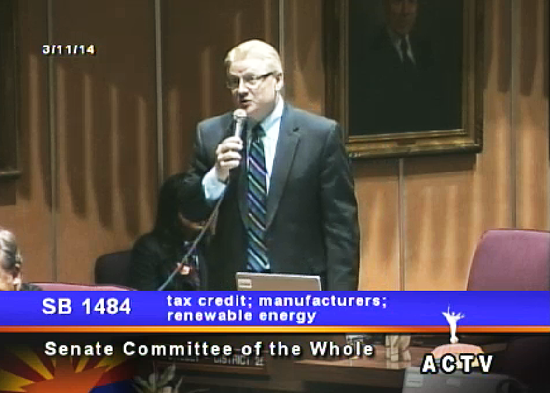

STATE CAPITOL — Its sponsor saying renewable energy is the best source of economic development in Arizona, a bill providing tax incentives for renewable energy facilities was cleared for third reading Tuesday in the state Senate. The measure is expected to be passed Wednesday and sent to the House.

SB 1484 establishes an individual and corporate income tax credit for investments of at least $300 million in a three-year period in new renewable energy facilities that produce energy for self-consumption using renewable energy resources if the power would be used primarily for manufacturing.

“These industries are most potent” in driving state’s economy,” said the bill’s sponsor, Sen. Bob Worsley, R-Mesa. “This is a way to attract a different breed of clientele.”

The credit is $1 million per year for five years for each renewable energy facility, and the maximum credit allowed per taxpayer per year is $5 million.