A real estate bill previously vetoed by Gov. Jan Brewer has been signed by Gov. Dough Ducey. It lowers property taxes for churches that lease space in commercial buildings.

A real estate bill previously vetoed by Gov. Jan Brewer has been signed by Gov. Dough Ducey. It lowers property taxes for churches that lease space in commercial buildings.

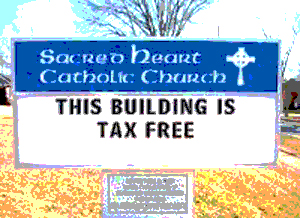

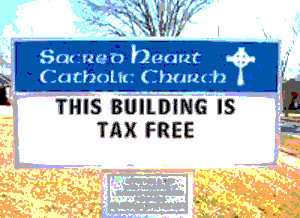

Churches and temples that own their own buildings don’t pay state property taxes, but religious groups that lease space pay the 18.5 percent rate paid by most businesses.

Opponents questioned more tax breaks when the state has been cutting education budgets and grappling with budget deficits. They also said the measure complicates tax bills for landlords and county assessors.