The Monday Morning Quarterback: A quick analysis of important economic data released over the last week

The Monday Morning Quarterback: A quick analysis of important economic data released over the last week

By Elliott D. Pollack and Company

While the economic news over the past few days has been negative (the stock market selloff, debt problems in Greece again and the Chinese government trying to curtail speculation in their stock market), the most recent data suggest that the U.S. economy is continuing to do modestly well. Consumers seem to be in a good mood, prices are under control, and business data is mostly positive (the one exception is the run up in inventories). Housing nationally is more mixed and continues to disappoint. That should not be a surprise. Yet, we believe that the outlook is still mostly positive and growth will continue both nationally and in Arizona.

Arizona Snapshot:

- Arizona’s non-farm employment increased by 66,700 jobs in March (2.6 percent) compared to a year ago. Nine of the 11 major sectors reported job gains and two reported job losses. Education and health services reported the largest gains. The seasonally adjusted unemployment rate stood at 6.2 percent in March.

- Greater Phoenix gained 55,500 jobs (3 percent) in March compared to a year ago. Tucson gained 5,700 jobs (1.6 percent) over that time period.

- After the first signs of recovery in housing appeared in December, January seemed disappointing. However, February again showed strength. The improvement came mainly in single family homes. Sales were up 18.6 percent in greater Phoenix and now stand 8.7 percent above a year ago. February new home sales in greater Phoenix jumped 26.9 percent compared to January and now stand 7.7 percent above a year ago.

- The new home sales price per square-foot was $139.32. This was a 1.7 percent drop from a year ago.

- According to RealData, the apartment vacancy rates in greater Phoenix dropped to 7.1 percent in the first quarter of 2015. This compares to 7.5 percent a year ago. Average rents were up 5.9 percent over the same time period.

U.S. Snapshot:

- Leading indicators moved up modestly in March. The index grew by 0.2 percent over February, but, is now 5.2 percent over a year ago. This report is soft and will not move expectations for a Federal Reserve rate hike forward.

- The University of Michigan consumer sentiment index for April was strong. The index stood at 95.9, up from 93.0 in March and 84.1 a year ago. The index hit an 8-year high of 98.1 in January.

- Consumer prices increased by 0.2 percent in March, the same level of increase as in each of the past two months. The index was flat compared to a year ago. The all items less food and energy index, known as the base rate of inflation, was up 1.8 percent from a year ago. These are good numbers and will allow the Fed to not rush rate increases.

- Industrial production declined 0.6 percent in March after a tepid gain of 0.1 percent in February and now stands 2 percent over a year ago. The March drop was largely due to utilities although manufacturing was soft. Market expectations were for a decline of 0.3 percent.

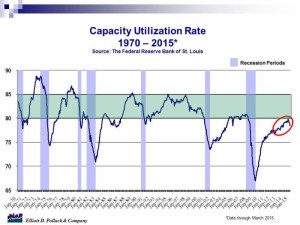

- Overall capacity utilization declined to 78.4 in March from 79 in February (see chart below). This is down from 79.1 a year ago and suggests that business will delay some plant spending.

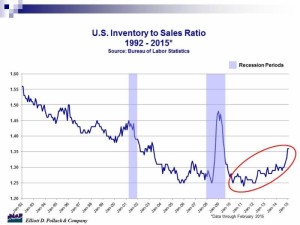

- The manufacturing and trade inventories to sales ratio stayed flat at 1.36 (see chart below). After bulging out late last year and in January this year, business inventory growth did not exceed sales growth in February. Inventories rose 0.3 percent, in line relative to sales and keeping the stock to sales ratio unchanged. Still, the 1.36 reading is the flattest since mid-2009 and needs to be watched. Inventory growth may add to first quarter GDP estimates but much of the buildup was unwanted. It was the result of weakness in underlying sales. High inventories do not encourage companies to expand or hire, no doubt a factor in the weakness of the March employment report.