A quick analysis of important economic data released over the past week

Elliott D. Pollack & Co.

The biggest event of last week is something that didn’t happen. The Fed did not raise interest rates and the stock market didn’t like that. It was interpreted as a sign that the Fed felt that the world and domestic economies were weaker than they should be and that would result in lower earnings growth and lower multiples on stocks.

That may be correct, but, it’s more likely that the Fed simply felt that (given everything that has gone on with the dollar, China and oil prices in combination with still below target inflation and other issues) taking a cautious view of things was probably warranted. As the economy continues to expand, albeit at a slow rate by historic standards, the Fed will probably act. They need to have a cushion for when the economy really does need stimulation.

Thus, while the economy is aging, it still has a way to go. Cut the Fed some slack.

Other economic news was mixed as would be expected at this stage of the cycle. While it’s not a great situation, it’s creating jobs and the economy is likely to expand for some time to come.

U.S. Snapshot:

The index of leading indicators inched up in August. It rose by 0.1% and now stands 4.4% above a year ago. It was flat in July. This suggests that economic growth will remain slow to moderate into next year.

Consumer prices fell 0.1% in August and now stand 0.2% above a year ago. This most certainly had an effect on the Fed and their decision not to raise rates yet. Most components of the index were flat to steady.

A reversal in the auto sector pulled down industrial production in August. It fell 0.4%. This was below expectations. Industrial production now stands 0.9% above a year ago.

The capacity utilization rate fell 0.5% and now stands at 77.6. A year ago it was 78.2. This indicates that there is still a good deal of excess capacity in the system for this point in the cycle. This has to be considered noninflationary.

The manufacturing and trade inventories to sales ratio held steady at 1.36 in July. This is substantially higher than 1.29 from a year ago and indicates that inventories remain on the heavy side. Most of the excess remains in autos.

For the second month in a row, upward revisions highlighted solid growth in retail sales. Retail sales rose 0.2% in August with ex-auto at a plus 0.1%.

According to CoreLogic, rising home prices led to improvement in home equity with 759,000 residential properties regaining equity in the second quarter compared to the first quarter. The percentage of homes with negative equity fell to 8.7% compared to 10.9% a year ago. Under-equitied homes fell to 17.8% from 19.3% a year ago.

Arizona Snapshot:

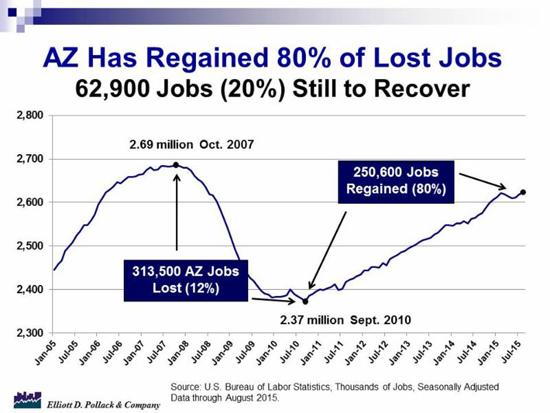

Arizona nonfarm employment grew by 2.1% (52,600 jobs) over a year ago in August. The sectors with the largest gains were Education & Health Services (14,200 jobs), Professional & Business Services (9,900 jobs), Leisure & Hospitality (9,200 jobs) and Trade, Transportation & Utilities (8,000 jobs). The state has now regained 80% of the jobs lost in the Great Recession (see chart below).

The state’s unemployment rate was 6.3%.

Arizona now ranks 13 out of 50 states in term of job growth for the first 8 months of 2015 compared to the same 2014 period.

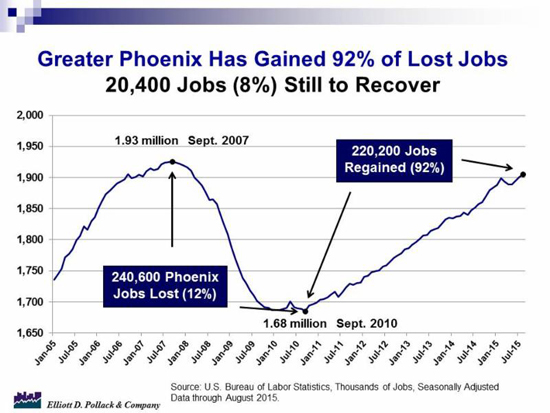

Great Phoenix fared better. As of August, the area has gained 44,900 jobs over the last year. The unemployment rate stands at 5.8%. While this is quite a recovery from the bottom, the unemployment rate is still high for this point in the cycle. The Greater Phoenix area has regained 92% of the jobs lost in the Great Recession (see below) and now ranks 14th out of 32 major employment markets in the U.S.

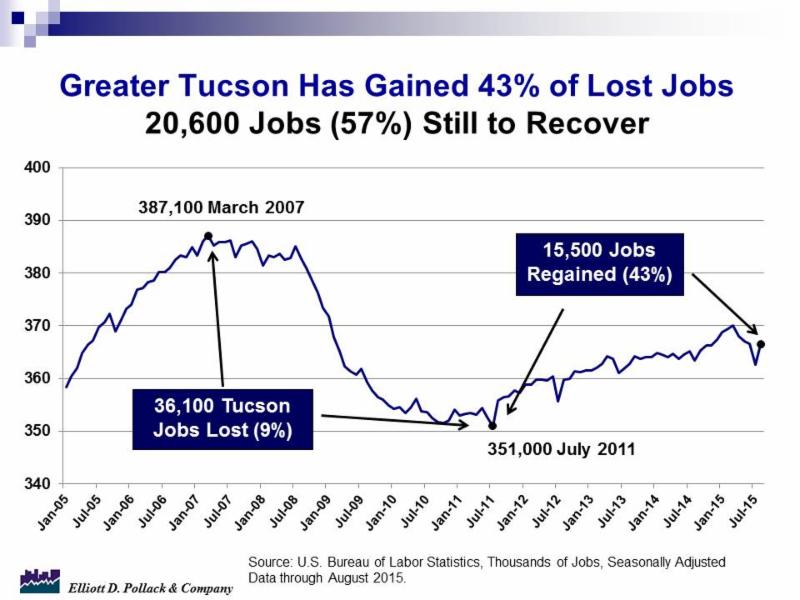

Greater Tucson has not fared as well. The Old Pueblo has gained only 3,300 jobs over the past year (August/August) for a 0.9% increase. The unemployment rate stands at 6.2% and Tucson has regained only 43% of the jobs lost in the Great Recession (see chart below).

The percent of homes with negative equity stands at 15.4% in Greater Phoenix compared to 19.5% a year ago and 8.7% nationally. The percent of homes that are under-equitied was 17.8% nationally but 22.1% in Greater Phoenix in the second quarter.

According to R.L. Brown, new single-family housing permits in Greater Phoenix were up more than 77% to 1,489. This compares to 838 a year ago. According to R.L., year-to-date there has been 10,902 permits for new homes issued. That’s up 43% for the same period last year. Through August, Greater Phoenix has now issued more permits than it did for all of last year.