ELLIOTT D. POLLACK & Company

FOR IMMEDIATE RELEASE

November 13th, 2017

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

The overall economic picture remains quite positive. Recent data has generally beat expectations. Financial conditions remain very positive given record highs in the stock market. The value of the dollar continues to decline which makes our exports look better. Labor markets continue to tighten as unemployment reached a 17-year low. And both consumer and business confidence remain at the highest levels in a decade.

Also, while the Trump administration has had its share of problems with legislation, the consensus still believes that there is a slightly better than 50% chance that Congress will ultimately approve legislation that provides tax relief for corporations and individuals. Although there will be significant push back by those who would lose their sacred cow tax deductions under the Trump plan, its provisions seem generally balanced and are likely to accomplish their general goals even given how late in the cycle the passage would occur.

Under these circumstances, it is not a surprise that the consensus forecast for both this year and next year increased last month. In addition, it appears that consumers have loosened their purse strings in terms of credit use as the holiday season approaches. Despite this, mortgage rates have remained flat over the past month and the local housing market remains tight. Overall, this is a good picture despite the unknowns.

U.S. Snapshot:

-

The Blue Chip Consensus Forecast suggests that 2017 will grow by 2.2% and that 2018 will grow by 2.5% (both year over year). Both of these numbers are improvements over the October survey. That would make 2018 the best year since 2015.

-

The University of Michigan consumer sentiment index edged down to 97.8 from October’s 100.7. The decline, however, was quite small as the sentiment index remained at its second highest reading since January.

-

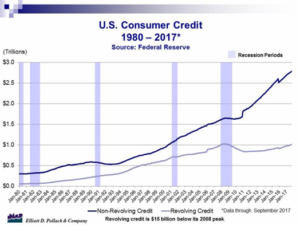

Consumer credit rose at a greater than expected 6.6% annual rate in September. Both revolving (credit card debt) and non-revolving (mainly student loan and auto debt) increased rapidly. This report suggests strength in consumer spending as the important Christmas selling season approaches. Revolving credit now stands 5.6% over a year ago and rose 0.6% over a month ago. Non-revolving credit also stands 5.6% above a year ago and rose 0.5% over a month ago.

-

30-year fixed rate mortgages rates stood at 3.90% for the week ending November 9. Generally, rates have been very stable over the past month centering on the 3.90% level.

Arizona Snapshot:

-

According to the Cromford Report, active listing in the Greater Phoenix area in October stood at 22,809. This is up modestly from September, but, down from 25,032 a year ago. That’s a decline of 8.9% over the same period a year ago.

-

Resale activity, again while down from September, was 4.4% above the October 2016.

-

The median price of a resale in October of this year was $245,000. That’s 7.0% above a year ago.

-

Days on market fell to 64.6 compared to 72.2 a year ago. Thus, the market, on a year over year basis, continues to tighten.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200