ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

February 4th, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

The increase in jobs in January far exceeded expectations. The gains were spread over several industries and suggest that the economy is still doing well even if the rate of growth in the economy is decelerating as expected. On the other hand, both measures of consumer confidence reported declines (though the overall levels of confidence are still high). How much of the decline in consumer confidence was due to the government shutdown remains to be seen. The next release of the survey results should tell us.

Other data tells us that manufacturing remains strong and private sector construction spending was positive. Sales of existing housing continues to be weaker than expected. Home prices have flattened out and new home sales, while picking up on a seasonal basis, remain below year earlier levels.

The data we see over the rest of the upcycle is likely to be mixed. But, overall, the strong jobs market should keep consumer spending reasonably buoyant. Wages should continue to grow faster than the rate of inflation. And the need for productivity growth should keep plant and equipment spending strong.

Housing remains an issue. Sales of both new and existing housing since October have been surprisingly disappointing. Move-up buyers were holding tight in the 4th quarter after increases in mortgage rates in the late 3rd and early 4th quarter pushed rates to levels that are high in comparison to most of the last eight years. And new buyers were apparently affected by a combination of higher rates and higher new home prices. Yet, the demographics remain favorable. And a strong jobs market and higher wages also help. Overall, housing should not be a drag on the economy going forward in 2019.

In summary, 2019 still looks like a positive year.

U.S. Snapshot:

-

Total non-farm payroll employment increased by 304,000 in January. Expectations were for about 180,000. This compares to an average monthly gain of 223,000 in 2018. Employment growth occurred across the board. Leisure and hospitality gained 74,000 jobs. Construction gained 52,000 jobs. Retail, transportation and warehousing as well as manufacturing also saw double digit gains. National employment now stands 1.9% above year earlier levels. The unemployment rate for the month was 4.0%. This compares to 3.9% last in December and 4.1% a year ago. In addition, average annual earnings were up 3.2% on a year over year basis. Thus, real wages are increasing.

-

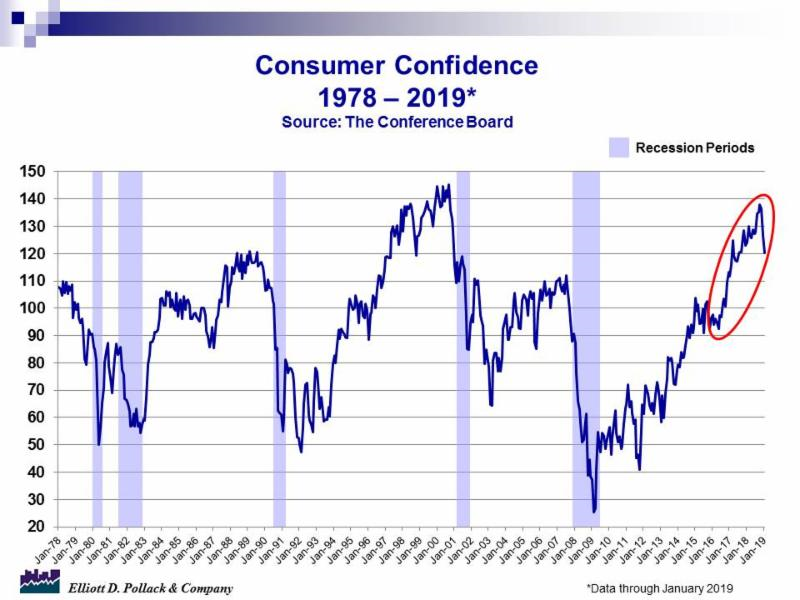

Consumer confidence dropped 6.4 points in January, falling to 120.2. This compares to 126.6 in December and 124.3 a year ago (see chart below). Most of the drop came from falling consumer expectations. Confidence in current economic conditions remains quite strong.

-

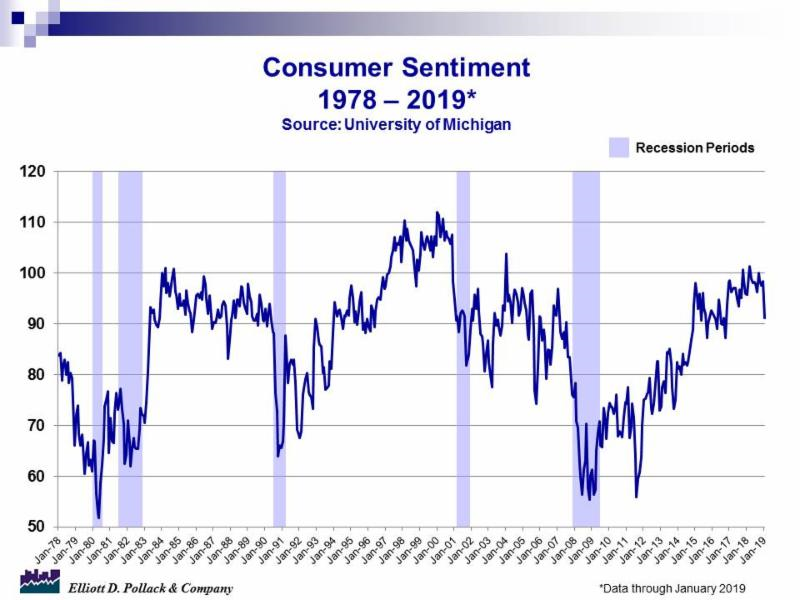

The University of Michigan consumer sentiment index is now at its lowest level since Trump was elected. The index in January was 91.2. This compares to 98.3 in December and 95.7 a year ago (see chart below). The end of the partial government shutdown caused only a modest boost in the index. This boost might be more significant once the shutdown is resolved on a more permanent basis.

-

The ISM manufacturing index in January stood at 56.6 compared to 54.3 in December. Any reading above 50 suggests that the manufacturing sector is expanding.

-

Private sector construction spending in November increased 1.3% compared to October. It now stands 2.3% above year earlier levels. Public sector construction spending for the month was down 0.9%.

-

Pending home sales declined as a whole in December. But, for the second straight month the western region experienced a slight increase. The stock market correction hurt consumer confidence. Record high home prices and higher mortgage rates cut into affordability. The government shutdown was reported to have only a minor impact. The index fell to 99.0 in December. This is down from 101.2 in November and 109.8 a year ago.

-

The weakness in housing reflected in the S&P/Case-Shiller home price index. The 20-city composite index fell 0.1% in November when compared to October. The index is still up 4.7% from year earlier levels.

-

November new single family home sales on a seasonally adjusted basis increased 16.9% compared to October. Sales were down 7.7% from a year ago. The November level was 657,000 units at a seasonally adjusted annual rate. In October, it was 562,000. The November 2017 level was 712,000.

Arizona Snapshot:

-

It was a busy year at Sky Harbor International. In December, enplanements increased by 2.8% over year earlier levels. Deplanements grew by 3.5% over year earlier levels. For 2018 as a whole, enplanements grew by 2.2% and deplanements grew by 2.5%.

-

Retail sales in Arizona grew by 10.1% in November over November 2017. In Maricopa County, retail sales grew by 11.1% over the same period. These are very strong numbers.

-

According to the S&P/Case-Shiller home price index, home prices in Greater Phoenix grew by 0.3% in November over October. Prices increase 8.1% in November compared to year earlier levels.

-

According to CBRE, Industrial vacancy rates in Greater Phoenix were 6.5% in the 4th quarter of 2018 compared to 6.8% a year earlier. For 2018 as a whole, there were 9,781,257 square feet absorbed.

-

According to CBRE, office vacancy rates in Greater Phoenix in the 4th quarter were 15.2% compared to 16.4% a year earlier.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200