By Jeff Jeffrey | Phoenix Business Journal

Washington’s political rancor is rippling across the nation’s real estate industry, as the recent federal shutdown has delayed a plan to unleash trillions in property investment in the country’s biggest cities and most impoverished communities.

Specifically, the delay has affected new rules for investing in so-called Opportunity Zones, and in the process has prevented many investors from exploiting one of program’s key benefits: the ability to sell long-held properties, more or less tax free.

The potential payoff, which limits capital gains taxes on investment gains that are then reinvested in Opportunity Zones, stems from a little-known provision in the federal tax code changes passed by Congress in 2017.

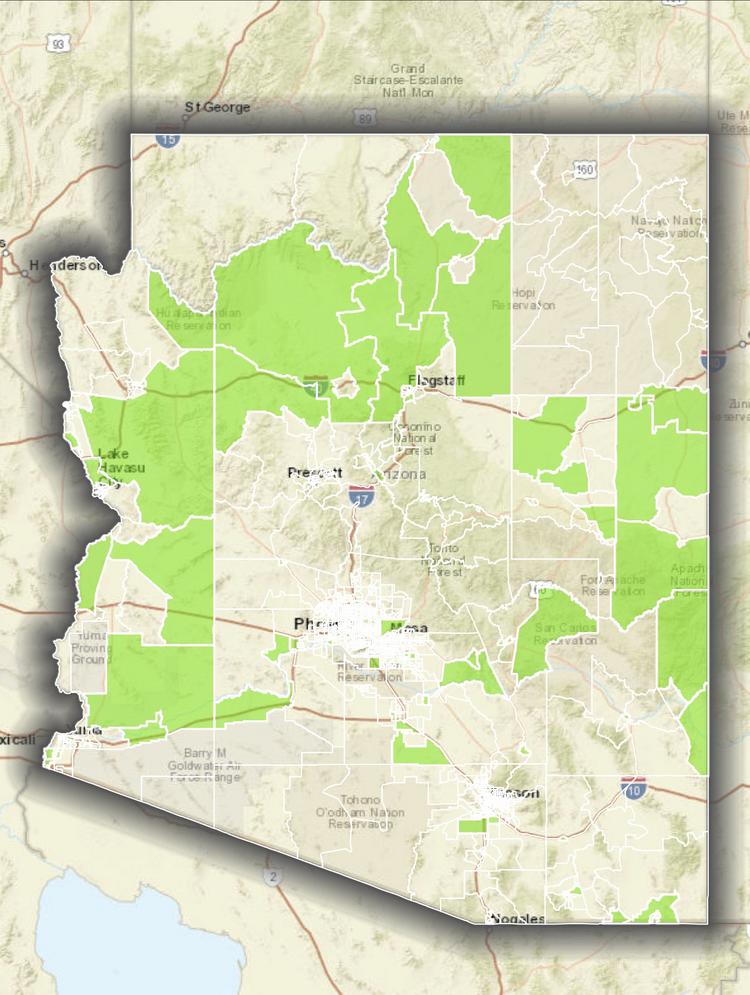

“Arizona’s opportunity zones are attracting investors from across the country, due in part to Arizona leadership’s proactive, thoughtful selection of qualified opportunity zones.”