ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

May 20th, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

Tariff issues between the U.S. and China dominated headlines early last week. The good news is that despite the back and forth chest pounding, plans for trade representatives to meet soon and continue to work towards a resolution continue to be on the table. In addition, a deal was reached last week regarding tariff issues between both the U.S. and Mexico as well as the U.S. and Canada and tariffs on certain products going between those countries will be lowered. That’s good news.

The economy continued to be upbeat last week. Leading indicators rose as did consumer confidence. Industrial production fell last month but is still up from a year ago. The same can be said about retail sales. Also, housing construction improved between March and April and home builders were more optimistic.

In Arizona, employment in April continued to be strong and the unemployment rate declined. The fastest growth, as usual, was in Greater Phoenix while Greater Tucson continued to lag. And despite increases in the median sales price of homes in Greater Phoenix, the area remains affordable compared to other major cities in the western U.S. Greater Tucson is still very affordable as well.

Overall, this is a picture that should be expected for an economy that is late in the game. The gains from the tax cuts have generally worked their way through the system and continued growth at a decelerating rate is likely to continue.

U.S. Snapshot:

The Conference Board Index of Leading Indicators increased 0.2% in April to 112.1. This compares to 111.9 in March and 109.1 a year ago. Stock prices, financial conditions and consumers’ outlook on the economy buoyed the index, although the manufacturing sector showed continued weakness.

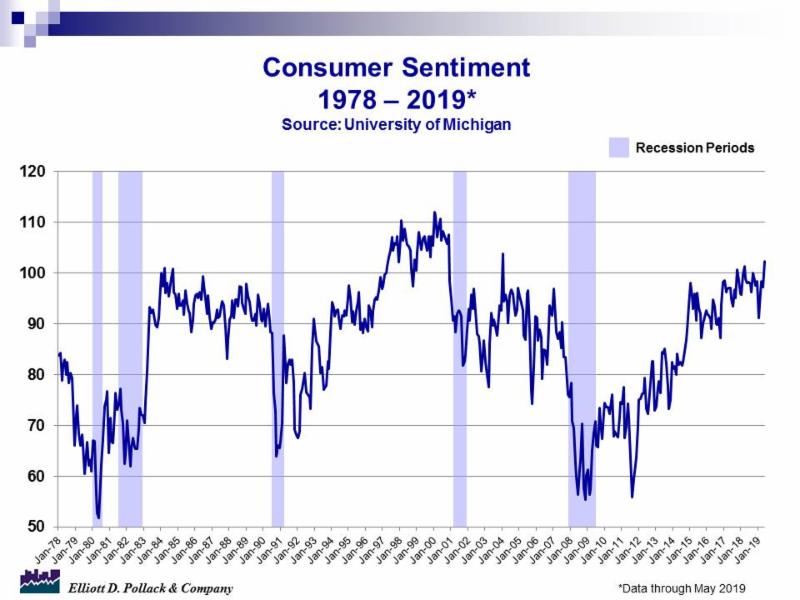

The University of Michigan consumer sentiment index (preliminary) for May increased to 102.4 from 97.2 in April and 98.0 a year ago (see chart below). Consumers viewed prospects for the overall economy much more favorably.

Industrial production fell to 109.2 in April. The March reading was 109.7. A year ago, it was 108.2. Output is now reported to have declined 1.9% (at an annual rate) in the 1st quarter.

Total sales of manufactured goods increased in March and now stand 3.7% above year earlier levels.

Privately owned housing units permitted in April were up 0.6% from March. But, permits are down 5.0% from year-earlier levels. The April seasonally adjusted annual rate of housing permits in April stood at 1,296,000. The decline was in the single-family sector.

Despite declines in permitting, the builder confidence as measured by the National Association of Home Builders rose to 66 in May compared to 63 in April.

Arizona Snapshot:

Arizona gained 12,500 nonfarm jobs over the month in April. This is higher than the historical 10-year average gain of 6,800 jobs. Over the last year, the state has gained 78,900 jobs. That’s a growth rate of 2.8%. Year-to-date through April, the state has gained 74,800 jobs (2.6% growth).

The state’s seasonally adjusted unemployment rate ticked down from 5.0% in March to 4.9% in April. During the month, the national unemployment rate declined to 3.6%. The Greater Phoenix unemployment rate drop to 3.7%.

Greater Phoenix grew by 68,000 jobs compared to a year ago in April. That’s a 3.2% growth rate. Year-to-date, the area grew by 63,700 jobs or 3.0%. In percentage terms, the big gainers were construction, manufacturing, educational and health services as well as professional and business services.

In Greater Tucson, jobs grew by 1.8% compared to a year ago. That’s 7,000 jobs. Year-to-date, the Old Pueblo grew by 6,000 jobs or 1.6%.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200