ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

July 1, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

The economic news last week was mixed. While 1st quarter GDP was strong, the outlook for the rest of the year is for slower rates of growth. And while corporate profits were up from a year ago and personal income growth remained respectable, consumer confidence by both major measures fell. The drop in consumer confidence was greater than expectations while the drop in consumer sentiment was more modest. Manufacturers’ new orders were mixed and housing prices continued to increase at diminishing rates. And despite low mortgage rates, new home sales were modestly down.

In Arizona, personal income was up. Also, home prices were up at a rate that was much faster than the nation as a whole. And Sky Harbor traffic, while up, was up at a slower rate than over the past few months.

It is no secret that this expansion is now the longest in U.S. history. But, this alone does not suggest that the end is near. What is more probable are slower rates of growth. The economy will have to be carefully watched in order to determine if and when a recession will occur. Slow growth is a more likely near-term scenario.

U.S. Snapshot:

Real GDP increased at an annual rate of 3.1% in the first quarter. That rate is likely to slow over the rest of the year.

The rate of growth in corporate profits was up in the first quarter of 2019 but at a slower rate of increase from previous quarters.

Personal income growth remained steady although the key wage and salary component appeared to be losing steam. Total personal income in May increased 0.5% and now stands 4.1% above year earlier levels.

Disposable personal income was up 3.9% from a year ago and personal consumption expenditures were up 4.2%. As a result of spending increasing more than income growth, the personal savings rate declined to 6.1% compared to 6.6% a year ago.

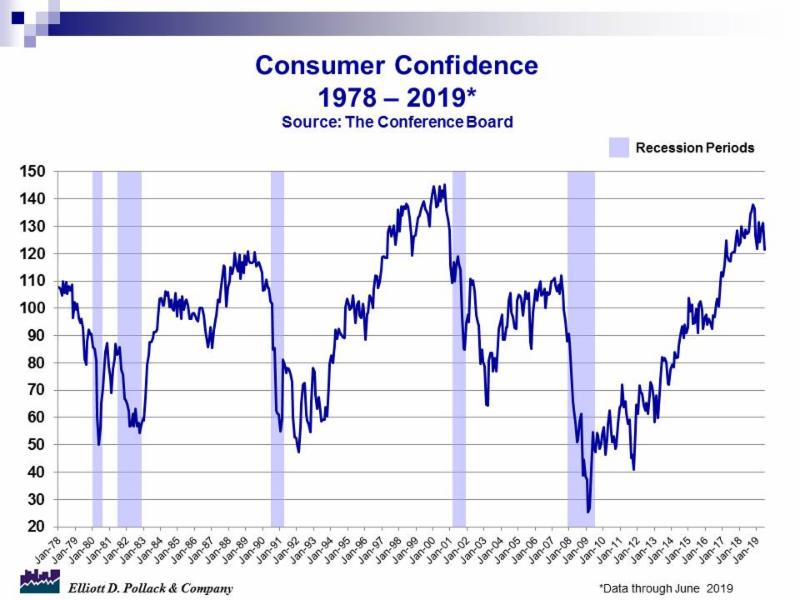

Consumer confidence as measured by the Conference Board declined from 131.3 in May to 121.5 in June (see chart below). A year ago, the index stood at 127.1. While the decline was greater than expected, confidence is still at high levels. Expectations dropped noticeably and are now the lowest since January.

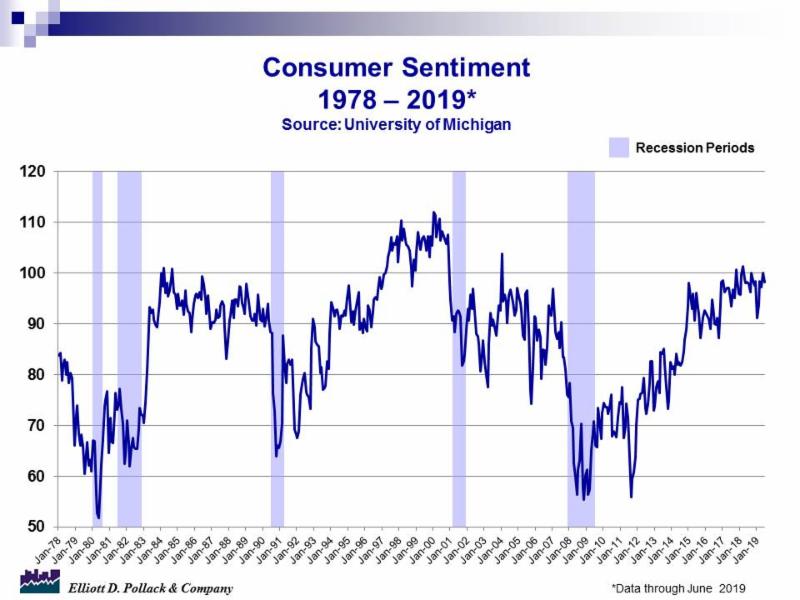

The University of Michigan consumer sentiment index declined modestly in June to 98.2 from 100.0 in May. The index now stands at the same level as a year ago (see chart below).

Advance manufacturers’ new orders for durable goods declined a modest 1.3% in May and now stand 2.8% below a year ago. Excluding the volatile aircraft sector, non-defense goods were up 0.4% from a month ago and 1.3% from a year ago.

The S&P/Case-Shiller home price index rose 0.8% in April over March. The 20-city composite index stood 2.5% over year ago levels. This is a modest rate of increase.

Sales of new single family houses in May were at a seasonal rate of 626,000. This is down 3.7% from year earlier levels.

The National Association of Realtors pending home sales index was 105.4 in May. This was up from 104.3 in April and down from 106.1 a year ago.

Arizona Snapshot:

Arizona personal income in the first quarter of 2019 was up 5.2% from year earlier levels and 1.4% from the fourth quarter of 2018. This was in line with expectations.

The S&P/Case-Shiller home price index for Greater Phoenix was up 0.8% from March in April and now stands 6.0% above year earlier levels. This is a rapid rate of growth compared to most other cities in the index.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200