ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

September 3, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

Hope you had a great and fun filled Labor Day weekend. Fortunately, last Friday was a lot less exciting than the previous Friday.

A week ago last Friday, it looked like an full-fledged trade war had broken out as President Trump announced that he was increasing tariffs on the tariffs he had already declared. And, he wanted U.S. companies to find alternatives to production in China. Then, supposedly, the Chinese called over the weekend and agreed not to retaliate and to return to the bargaining table. The Chinese claim to know nothing about this. Yet, the stock market regained the losses from the previous week. It seems like for the moment the worst has passed. Time will tell.

In the meantime, the economic news over the past week was again mixed. On the positive side, durable goods orders were up. Home prices were up but the rate of increase is moderating. The UK is playing poker with Brexit in an attempt to get the best deal they can get. And, the two major indicators of consumer confidence tell different stories.

As for Arizona, activity at Sky Harbor is up but at a moderating rate. Retail sales in the state and in Maricopa County remain healthy. And Greater Phoenix housing prices continue to rise more rapidly than in most places in the country.

Economic life is not dull.

U.S. Snapshot:

Adjusted corporate profits increased 2.7% from year earlier levels in the second quarter. This indicates a rebound from the decline of 2.2% (year over year) that occurred in the first quarter.

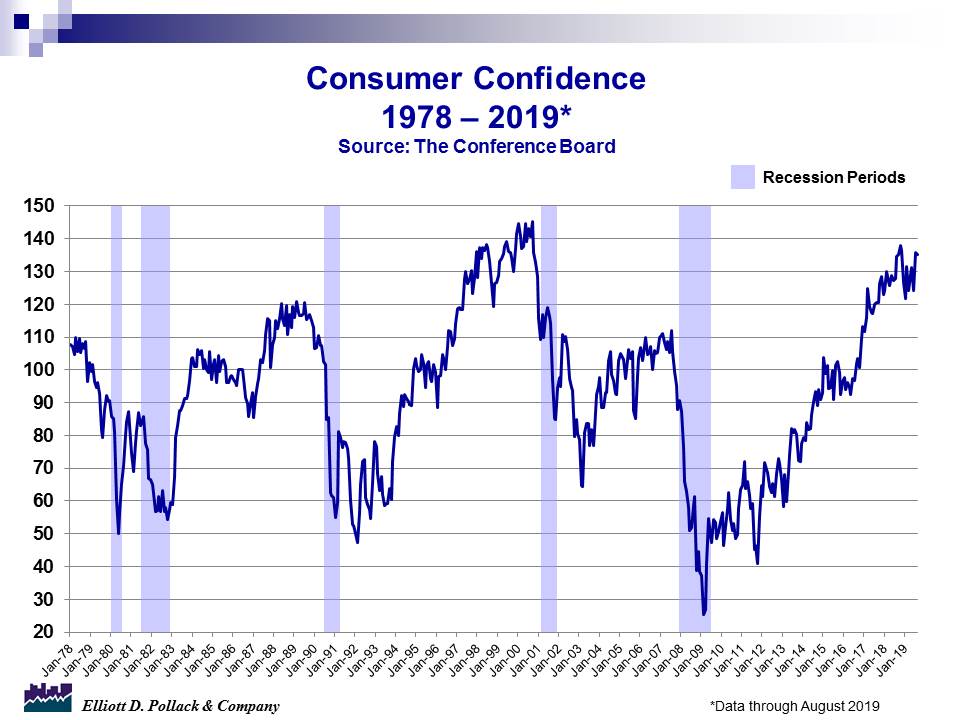

Consumer confidence as measured by the Conference Board remained strong in August despite the stock market’s wild ride, recession concerns, and trade tensions. What the take away is this month is that the strength in the labor market is offsetting the drag on sentiment. The index slipped but only marginally to 135.1 in August from 135.8 in July and 134.7 a year ago (see chart below). The results suggest that consumers are feeling good.

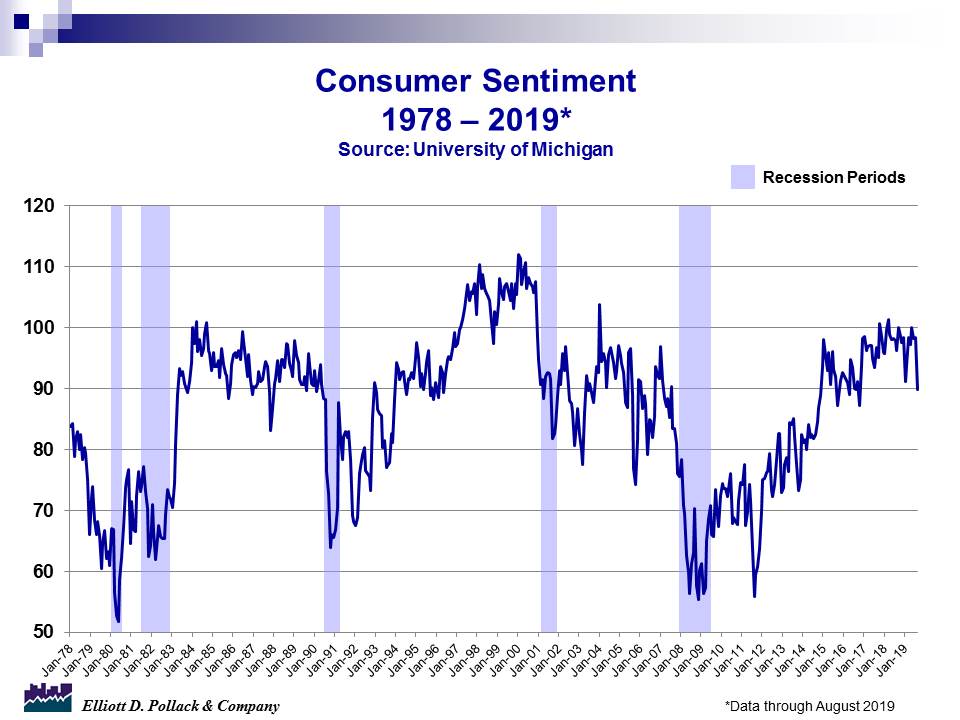

The other major measure of consumer confidence, the University of Michigan consumer sentiment index, showed a different picture. The August index dropped to 89.8 compared to 98.4 in July and 96.2 a year ago (see chart below). The August result showed that the index posted its largest decline since December 2012. The August decline was due to negative references to tariffs, which were spontaneously mentioned by one in three consumers polled. The index is still at a high level. Which of the measures turns out to be right remains to be seen.

Orders for manufactured durable goods in July increased 2.1% from June and 1.0% from a year ago. This is the second consecutive month of gains.

The National Association of Realtors pending home sales index reversed course in July after two consecutive months of gains. The index fell to 105.6 compared to 108.3 in June. A year ago, the index stood at 105.9. Apparently, low mortgage rates have not yet consistently pulled buyers back into the market. According to NAR chief economist Laurence Yun, economic uncertainty is holding back some potential demand. But, the biggest problem, he believes, is the lack of supply of moderately prices homes.

The S&P/Case-Shiller home price index continued to slow in June. The 20-city composite index was up 2.1% from year earlier levels. This is the slowest rate of increase in seven years.

Arizona Snapshot:

Air traffic at Sky Harbor International Airport in Phoenix continued to moderate on a year over year basis. In June, air traffic was up 1.6%. In July, it was up 0.5%. This is a trend that will have to be watched.

Retail sales in the state were up 5.7% on a year over year basis in June. This is the same rate of growth as in May. The growth rate is strong. In Maricopa County, retail sales in June were up 6.5% from a year ago. This compares to May when the gain was 6.0%.

According to the S&P/Case-Shiller home price index for Greater Phoenix, home prices were up 5.8% in June when compared to year earlier levels. Greater Phoenix and Greater Las Vegas have led the country in home price gains over the past year. This reflects the supply/demand imbalance that exists in Greater Phoenix as demand continues to outstrip supply, especially for moderately priced homes. Hopefully, there will be a slowdown in price gains as has occurred in most other markets.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200