ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

October 28, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

It was another mixed week for the economy. This was hard to pick up given all the political and impeachment noise. Not that this isn’t important in terms of the economy. Quite the opposite. For instance, a Sanders or Warren presidency would have significantly different implications for the economy than would a Trump presidency. That is something that the American people will decide. But, different policies will have different implications.

As for economic news, on the positive side, initial unemployment insurance weekly claims suggest that labor markets are still tight. In fact, it would not be surprising to see the employment growth data that will be released at the end of this week to be a little disappointing since so many people now have jobs. It would suggest that there are simply not enough unemployed that are still looking for work. We shall see. In addition, consumer sentiment remained strong. On the other hand, manufacturers’ new orders were down. Most of this, though, related to troubles at Boeing.

Existing home sales were up over last year. But, only marginally so. Given the continued growth in the economy and low mortgage rates, it should have been higher. It appears to be about lack of lower priced inventory and affordability. The same can be said of new home sales. It is interesting, though, that the median price of a new home was down from both last year and last month. Again, it’s all about affordability. (Thanks, in part, to student loans.)

The other piece of data that was troublesome is that this year’s federal deficit will be approaching $1,000,000,000,000. A trillion dollars. It’s very high for this point in the cycle. Not good.

As for Arizona, lodging performance continues to improve. And in Greater Phoenix, apartment, office and industrial markets continue to do well.

U.S. Snapshot:

Initial claims for unemployment insurance last week declined by 6,000 to 212,000. The key takeaway from the report is that there are no alarming trends in this series for the consumer outlook as jobless claims continue to track close to historic lows.

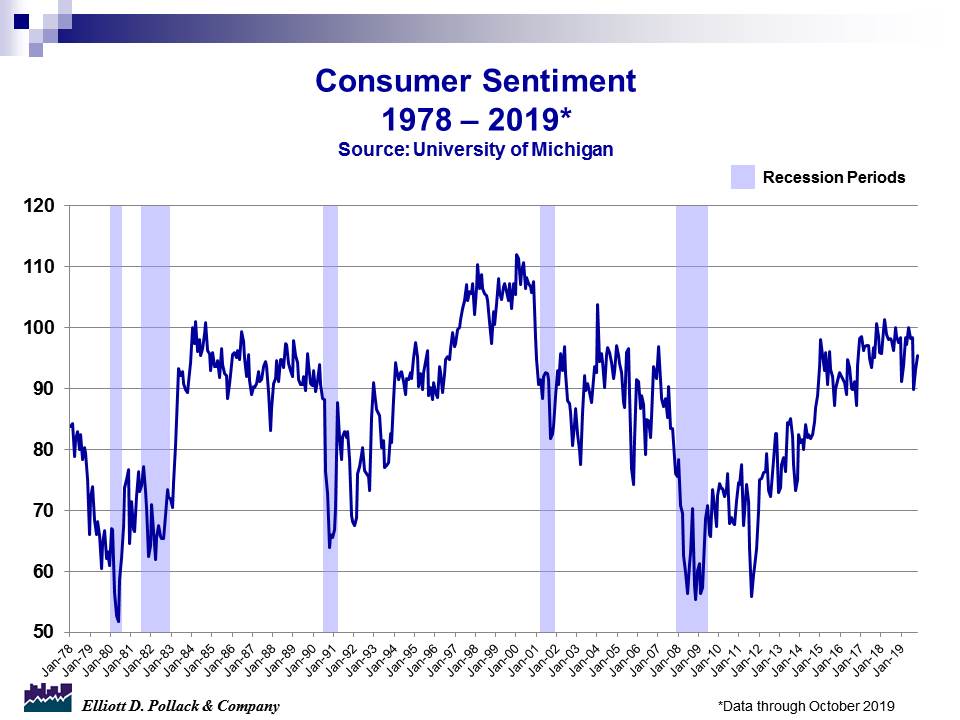

The University of Michigan Consumer Sentiment Index remained at levels that can only be considered quite favorable. They are largely unchanged from the levels of the past few years. The index stood at 95.5 in October compared to 93.2 in September and 98.6 a year ago (see chart below).

Manufacturers’ new orders for durable goods were down 1.1% in September when compared to August and were down 5.4% compared to year-earlier levels. Excluding aircraft, the declines were 0.5% for the month and 0.8% from a year ago. A large part of this was because of trouble at Boeing.

New home sales, at a seasonally adjusted rate of 701,000 in September, were down 0.7% from August but were up 15.5% from year-earlier levels. This is a good performance from a year ago. As for the month, it was a little disappointing. New home sales, given current employment levels and mortgage rates, should be strong. Part of the problem is simply a lack of affordable inventory. It is interesting to note that the median sale price in September was $299,400 compared to $325,200 in August and $328,300 a year ago. So, it is the lower-priced housing that is selling. Whether this is a trend or an aberration will be worth following.

Existing home sales slowed in September following two months of increases. Sales were down 2.2% from August levels but were up 3.9% from a year ago. This is good but not great given the underlying demographics and current economic conditions. Median prices were up 5.9% from a year ago.

Arizona Snapshot:

Statewide lodging performance continued to improve in the third quarter of 2019. Occupancy rates were 64.6% compared to year-earlier levels of 62.8%. Demand for rooms increased 3.5% over year earlier levels while the supply of rooms increased 0.6%.

Lodging performance in Greater Phoenix also improved in the third quarter. Occupancy improved to 62.5%. That’s up from 61.1% a year ago. Demand grew by 3.3% over the year while supply was up 1.0%.

In Greater Tucson, occupancy increased to 60.5% in the third quarter. That’s up from 57.0% a year earlier. Demand was up a strong 4.8% while supply declined by 1.2%.

According to ABI Multifamily, there were 14,728 apartment units under construction in the third quarter. That’s down 6.4% from a year ago. The number of apartment units planned jumped to 22,738 in the third quarter. That’s up 24.6% from year earlier levels.

According to CBRE, the Greater Phoenix office market had a great third quarter of 2019. Tenant demand continued strong with 1,426,462 square feet absorbed compared to a change in inventory of 1,660,939 square feet as several build to suit buildings were completed. Vacancy rates declined from year earlier levels and ended the quarter at 14.4% compared to 15.7% a year ago. Rental rates were $26.76 compared to $26.03 a year earlier. Office product under construction dipped slightly at the end of the quarter to about 1.5 million square feet.

According to CBRE, the Greater Phoenix industrial market continues to do very well. Over 3.9 million square feet were absorbed in the third quarter while change in inventory was almost 2.8 million square feet during the quarter. As a result, vacancy rates dropped to 6.1%. Currently, there are almost 12 million square feet of industrial space under way. This is the highest quarterly total since the third quarter of 2007.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200