ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

November 12, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

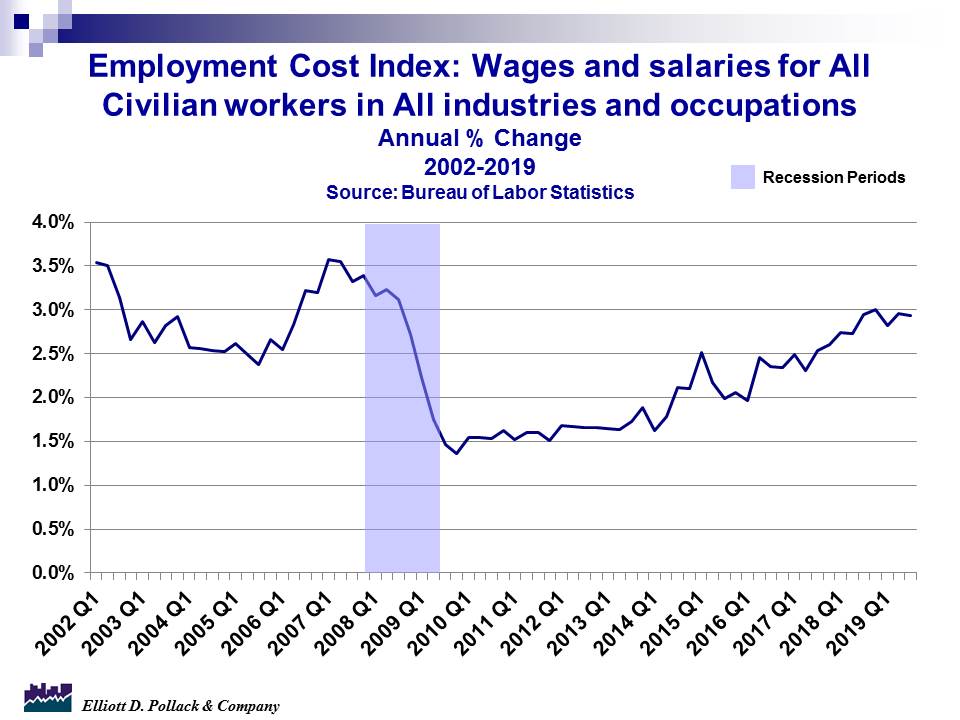

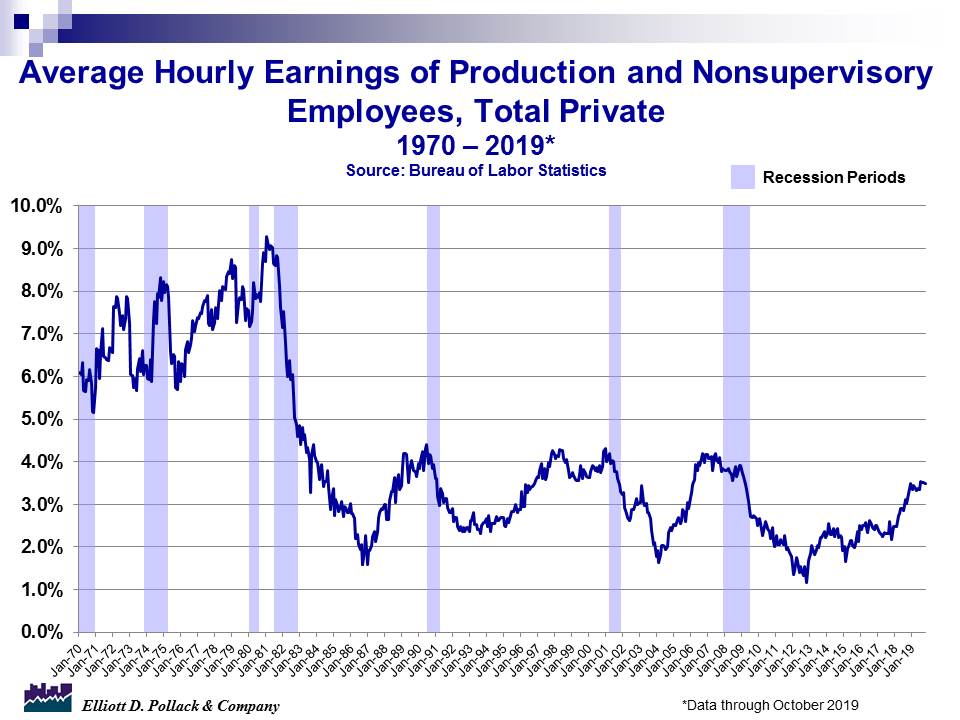

Before getting to the latest news, last week I mentioned that I wanted to discuss why wages have not increased more rapidly given the 50-year low in unemployment. The truth is that no one knows for sure, so I offer a few data points and a few ideas for further consideration.

To be clear, wages have increased, but, just to moderate levels. The data indicates that the low end of wage earners have benefited the most. Some of the explanation lies in that people are continuing to come off the short-term unemployment rolls to reenter the job market. This is true for those on disability as well.

Subjectively, it appears to me that, at least for service firms, the level of quality of the workers hired has declined. This might be remedied by training and time. It also could be that businesses are making the tradeoff between labor and capital or that businesses are not seeing the demand they had hoped for so are not as pressured to hire enough to force a faster growth in pay. Given the slowing economy, this is likely to continue as consumers continue to save more of their pay.

Overall, it appears to me that we have not yet reached the point when businesses decide that they have to pay a lot more to get the quality of employees they can’t get today. When and if they hit that point remains to be seen.

Now, on to the latest in the economy. Last week featured both interesting economic data and interesting economic rumors. First the rumors. The Chinese Commerce Ministry announced on Friday that negotiators from Washington and Beijing “agreed to remove the additional duties imposed on each other’s products in different phases after they make progress” in striking a deal. Later, President Trump said he has not agreed to scrap tariffs on Chinese goods. The stock market liked the Chinese version better than the Trump version. Realistically, until intellectual property rights issues are resolved, not much is likely to happen. The Trump administration has slapped tariffs on more than $500 billion of Chinese goods while Beijing has put duties on about $110 billion of American products. It’s still a trade skirmish, not a trade war.

As for news, initial unemployment claims seem to be indicating that the jobs market remains on solid footing. This is true despite the number of unfilled jobs falling a little. There are still more than 7 million unfilled jobs which is very high by historic standards. In that regard, consumer confidence remains high. The non-manufacturing sector remains strong. Consumers have been stingy with their use of credit. And according to the National Association of Realtors, housing prices continue to grow at a rate faster than inflation.

The most important piece of information last week had to do with the affordability of housing. According to the National Association of Homebuilders, affordability of housing increased meaningfully in the last quarter. Affordability was at its highest level since the first quarter of 2016. This is good news for the U.S. housing market. As for Arizona, once again active listing declined from year earlier levels while resales increased over the same time period. The market continues to tighten. Lack of inventory continues to be a big problem. At least some help is on the way as affordability improves markedly in both Greater Phoenix and Greater Tucson.

U.S. Snapshot:

The University of Michigan Consumer Sentiment Index in early November was nearly identical to last month’s and the average 2019 level. Apparently, consumers have not been bothered by all the political noise surrounding tariffs and impeachment. The November index was 95.7. This compares to 95.5 last month and 97.5 a year ago and remains near this cycle’s high.

Consumer credit increased at a 2.8% annual rate in September and now stands 4.9% above year-earlier levels. Revolving credit (credit cards) actually declined at a 1.2% annual rate while non-revolving credit (auto debt and student loans) increased at a 4.2% annual rate. Revolving and non-revolving debt levels now stand 3.5% and 5.4% respectively above a year ago.

October auto sales were down 3.4% from a 17.1 million unit annual rate in September to a 16.5 unit annual rate in October. This more modest level of auto sales was going to occur sooner or later because the underlying demand is probably less than 17.1 million units. The weakness in auto sales is likely to show up in this week’s retail sales data.

The ISM’s non-manufacturing index rose modestly in October to 54.7 from 52.6 in September and 60.0 a year ago. Any reading above 50 indicates that the non-manufacturing sector is expanding. This was the 117th consecutive month of expansion in that sector.

The number of job openings edged down to 7.0 million in September from 7.3 million in August and 7.4 million a year ago. This is still a high level of job openings by historic standards (see chart below).

According to the National Association of Realtors, an overwhelming majority of metro areas experienced price gains with very limited inventory growth in the third quarter. Year over year median prices increased in 166 of the 178 markets measured. The national median price for an existing single-family home was $280,200. That’s up 5.1% from year-earlier levels.

The NAHB housing opportunity index increased in the third quarter to 63.6. That’s up from 60.9 in the second quarter and 56.9 a year ago. It’s the highest level (indicating that more people can afford a home) since first quarter of 2016. A combination of a three year low in mortgage rates and continued strength in the job market helped housing become more affordable.

According to economist Rodney Johnson of Dent Research, “In a paper published by Bioscience, 11,000 scientists signed on to support the case for a climate emergency. Unsurprisingly, they found that wealthy nations are the biggest culprits as they drive gas-guzzling cars and eat meat sourced from ruminating animals (cows). To avert a climate disaster, they recommend changes in six areas: food, nature, energy, short-lived pollutants, economy, and population. It’s the last one that will catch your attention. This group calls for ending population growth and, in a perfect world, reducing the population while maintaining a framework that ensures social integrity. They don’t define that last part. But it likely means a framework they design. No word on the scientists giving up their cars and refusing to ride on airplanes or eat red meat.”

Arizona Snapshot:

- According to the Cromford Report, active listing in the Greater Phoenix MLS declined from 21,279 in October of 2018 to 18,482 in October 2019. On the other side of the supply/demand equation, resales increased from 7,352 units a year ago to 8,018 this October. This indicates that month’s supply of resale homes dropped from 2.9 a year ago to 2.3 months now. Not surprisingly, the median sales price of an existing home rose to $285,000. That’s up 8.8% from last October.

- Affordability rose in both Greater Phoenix and Greater Tucson in the third quarter. In the Phoenix market, affordability rose to 68.0 compared to 65.1 in the second quarter and 57.1 a year ago. This indicates that 68% of the families in the Greater Phoenix area can afford the median-priced home. In Greater Tucson, the index stood at 72.9 compared to 70.0 in the second quarter and 67.1 a year ago.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200