ELLIOTT D. POLLACK& Company

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

It was a slow week for national economic news. Leading indicators were essentially flat. Monthly existing home sales increased substantially from a year ago in December but were up only modestly for the year (2019 over 2018). And the supply/demand imbalance in the country caused resale prices to increase at four times the overall rate of inflation and more rapidly than wage gains for the December over December measure but were up more modestly for the year as a whole.

This is because when interest rates declined during the year it allowed more of the pent up demand for housing to manifest itself. Other than that, it was political. The impeachment trial got underway in the Senate. And according to the Washington Examiner, the death of Mr. Peanut, the Planters Peanut symbol for the last 104 years, overshadowed the first day of impeachment arguments on Twitter.

Is the public telling us something? On the local level, the latest Arizona, Greater Phoenix, and Greater Tucson employment data shows that the state and its major metro areas are continuing to do well economically. Arizona remained the third most rapidly growing state in 2019 and Greater Phoenix was the third most rapidly growing major employment market in the country in 2019. Thus, the state and Greater Phoenix are going into 2020 with a full head of steam. The same can be said for the single family, apartment, office and industrial real estate markets in Greater Phoenix.

U.S. Snapshot:

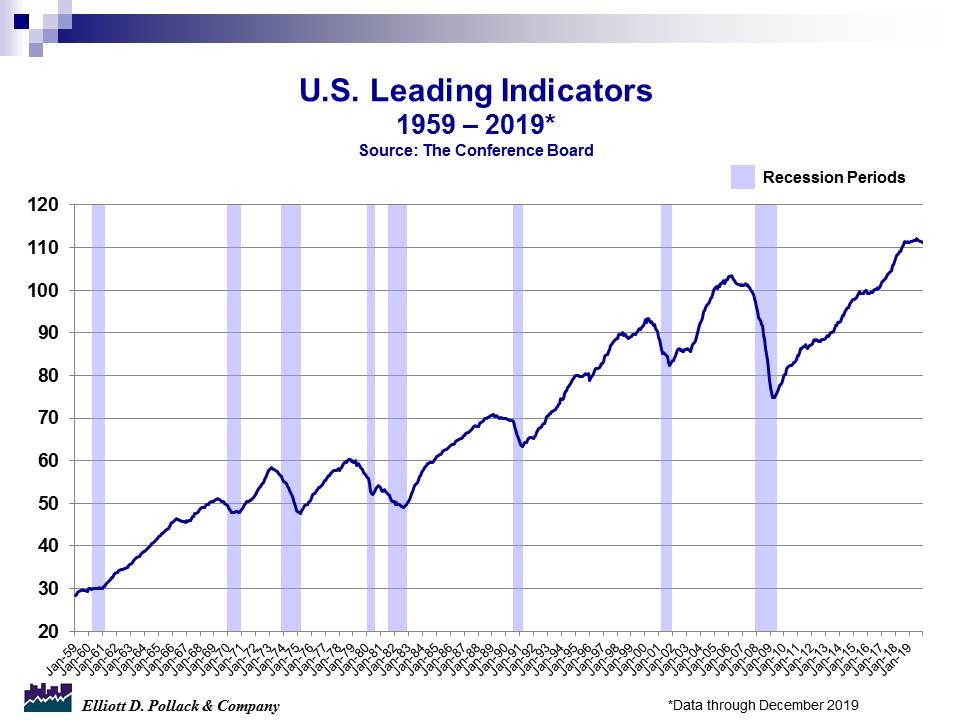

The Index of Leading Indicators fell modestly in December to 111.2. This is a 0.3% drop from November’s 111.5 and a 0.1% increase over December 2018 (see chart below). It is worth noting that leading indicators have modestly declined in four of the last five months. The manufacturing indicators are pointing to continued weakness in the sector. However, financial conditions and consumers’ outlook for the economy remain positive.

Existing home sales grew by 3.6% in December when compared to November. They were up 10.8% over December 2018. For 2019 as a whole new home sales were flat for the year and single family sales were up a modest 0.5%. This indicates a significant rebound in housing the second half of 2019. The declines in mortgage rates helped free up some of the huge pent up demand for housing. The lower mortgage rates help offset the effect of higher prices on affordability as home prices increased by 7.8% December over December and 4.8% when comparing 2019 to 2018.

Arizona Snapshot:

Employment figures for both December and full year 2019 came out this week. The numbers show continued solid growth in the state as a whole, Greater Phoenix, and Greater Tucson.

For the state as a whole, December employment was up 2.9% from December 2018 or 84,400 jobs. And for the year as a whole, employment in the state was up 2.6%. While this is somewhat slower than the 2.8% growth in 2018 over 2017, it is still strong. And while the rate of growth in employment has modestly slowed in the second half of the year, the state is entering 2020 on solid footing. Arizona remains the third most rapidly growing state (percentage terms) in the U.S. behind Utah and Nevada.

For the year as a whole, employment was up 74,800 jobs. The sectors with the biggest gains in absolute terms were Educational and Health Services with 19,300 jobs, Construction with 16,000 jobs, Trade, Transportation and Utilities with 10,500 jobs and Professional and Business Services with 10,000 jobs.

In percentage terms, the employment sector leaders were Construction with 10.1% growth, Manufacturing at 4.4% growth, Educational and Health Services at 4.3% and Natural Resources and Mining at 4.3%.

Greater Phoenix employment growth was up 3.2% from December 2018 to December 2019. That’s 68,800 jobs or more than 81.5% of all the jobs created in the state over that period of time. When comparing 2019 with 2018, growth was 2.9% or 61,800 jobs. That’s 82.6% of all the jobs in the state. The 2.9% for 2019 compares to 3.3% in 2018 and 3.0% in 2017. The 2019 number is likely to be revised upward when revisions are released in March. The present numbers paint a bright picture for Greater Phoenix. It is now the third most rapidly growing major market in terms of percentage employment in the country. Only Dallas at just under 3.1% and Orlando at just under 3.6% grew more rapidly in 2019.

Greater Tucson grew by 8,800 jobs or 2.3% on a December over December basis. On a year over year basis, Tucson was up 1.9% or 7,300 jobs. This was the best year for Tucson since 2006.

According to CBRE, the Greater Phoenix industrial market continues to do well. In the 4th quarter of the year, 2.6 million square feet of industrial space was absorbed while 3.3 million square feet was brought on stream. Thus, vacancy rates increase modestly from 6.1% in the 3rd quarter to 6.3% in the 4th quarter. This is still very low by historic standards. For 2019 as a whole, 10.7 million square feet was absorbed while 9.1 million square feet was delivered. Vacancy rates for the year as a whole declined from 6.5% to 6.3%. Rental rates were up almost 8%.

According to CBRE, the Greater Phoenix office market also did well in 2019. In the 4th quarter, absorption of office space was 830,401 square feet while change in inventory was 558,731 square feet. Thus, vacancy rates dropped from 14.4% in the 3rd quarter to 14.1% in the 4th quarter. For 2019 as a whole, 3.2 million square feet was absorbed 2.8 million square feet was delivered.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200